The Swanlake Tax Services business was established on 1 March of the current year to help clients

Question:

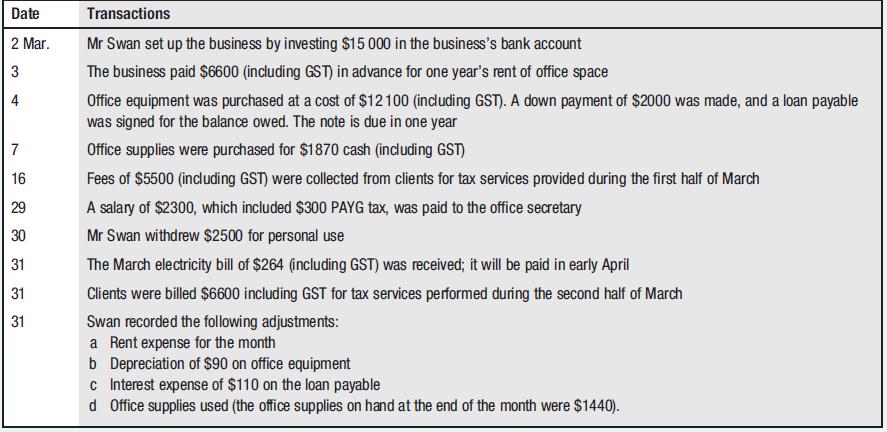

The Swanlake Tax Services business was established on 1 March of the current year to help clients with their tax planning.

During January, the business entered into the following transactions:

Required:

a Using the following column headings or account titles, prepare a worksheet to record the above transactions: date, cash, prepaid rent, office equipment, office supplies, accounts receivable, GST paid, notes payable, electricity payable, GST collected, PAYG payable, capital, tax service revenue, salary expense, electricity expense, rent expense, depreciation, interest expense, office supplies expense.

b Prepare a trial balance.

c Prepare a classified income statement for the business for March.

d Prepare a balance sheet for the business on 31 March.

e Briefly comment on how well the business did during March.

Step by Step Answer:

Accounting Information For Business Decisions Accounting

ISBN: 9780170446242

4th Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh