Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing

Question:

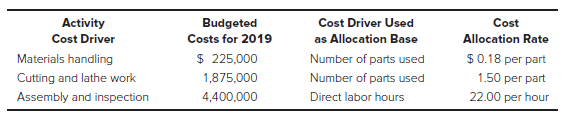

Woodland Industries manufactures and sells custom-made windows. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning three manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $18 per hour and that there were no beginning inventories. The following information was available for 2019, based on an expected production level of 50,000 units for the year, which will require 200,000 direct labor hours:

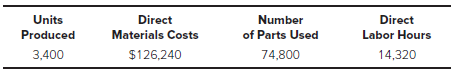

The following production, costs, and activities occurred during the month of July:

Required:

a. Calculate the total manufacturing costs and the cost per unit of the windows produced during the month of July (using the activity-based costing approach).

b. Assume instead that Woodland Industries applies manufacturing overhead on a direct labor hours basis (rather than using the activity-based costing system previously described). Calculate the total manufacturing cost and the cost per unit of the windows produced during the month of July. (Hint: You will need to calculate the predetermined overhead application rate using the total budgeted overhead costs for 2019.)

c. Compare the per unit cost figures calculated in parts a and b. Which approach do you think provides better information for manufacturing managers? Explain your answer.

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele