Question: The Canyons Resort, a Utah ski resort, recently announced a $415 million expansion of lodging properties, lifts, and terrain. Assume that this investment is estimated

The Canyons Resort, a Utah ski resort, recently announced a $415 million expansion of lodging properties, lifts, and terrain. Assume that this investment is estimated to produce $99 million in equal annual cash flows for each of the first 10 years of the project life.

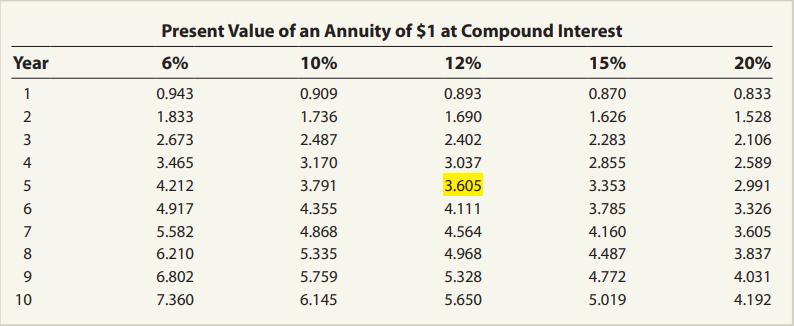

a. Determine the expected internal rate of return of this project for 10 years, using the present value of an annuity of $1 table found in Exhibit 5.

b. What are some uncertainties that could reduce the internal rate of return of this project?

Exhibit 5:

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

To determine the expected internal rate of return IRR of the project we need to find the discount rate that equates the present value of the cash flows to the initial investment Given Initial investment 415 million Annual cash flows 99 million for 10 years We can use the present value of an annuity formula to calculate the IRR The formula is as follows PV CF 1 1 rn r where PV is the present value CF is the annual cash flow ... View full answer

Get step-by-step solutions from verified subject matter experts