1. Journalize the following transactions of Lyons Communications, Inc.: 2. At December 31, 2018, after all year-end...

Question:

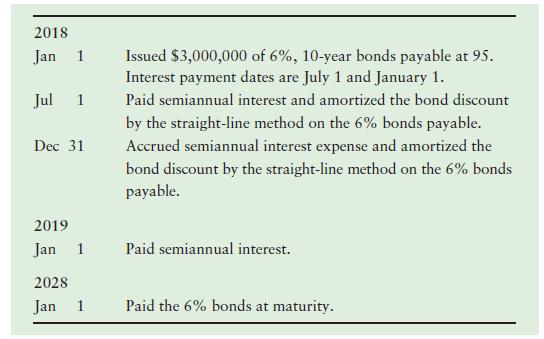

1. Journalize the following transactions of Lyons Communications, Inc.:

2. At December 31, 2018, after all year-end adjustments have been made, determine the carrying amount of Lyons’ bonds payable, net.

3. For the six months ended July 1, 2018, determine the following for Lyons:

a. Interest expense

b. Cash interest paid

What causes interest expense on the bonds to exceed cash interest paid?

Transcribed Image Text:

2018 Issued $3,000,000 of 6%, 10-year bonds payable at 95. Interest payment dates are July 1 and January 1. Jan 1 Jul 1 Paid semiannual interest and amortized the bond discount by the straight-line method on the 6% bonds payable. Dec 31 Accrued semiannual interest expense and amortized the bond discount by the straight-line method on the 6% bonds payable. 2019 Jan 1 Paid semiannual interest. 2028 Jan 1 Paid the 6% bonds at maturity.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

1 Journal Entry for Lyons Communications Inc Date Account Name Deb...View the full answer

Answered By

Subham Agrawal

I believe how to learn is more important rather than just learning. It is crucial to like what you study and why you study even if you think you hate studies. I have tutored a number of high school students as a professional tutor. I used to work in Information Technology Tutor lab while completing my masters degree as well. I like to engage people while studying and go through my thought process while solving a problem to make sure my students can learn in depth.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

1. Journalize the following transactions of Laporte Communications, Inc.: 2. At December 31, 2018, after all year-end adjustments have been made, determine the carrying amount of Laportes bonds...

-

Account for bonds payable at a discount; amortize by the straight line method Requirements 1. Journalize the following transactions of Laroux Communications, Inc.: 2. At December 31, 2012, after all...

-

Account for bonds payable at a discount; amortize by the straight-line method Requirements 1. Journalize the following transactions of Lamothe Communications, Inc.: 2. At December 31, 2012, after all...

-

Assume you are offered a lease for a car with $227 monthly payments for 36 months after a $2,540 up front (down) payment. The alternative is that you can buy the car for $31,000 and make a $3,200...

-

Niche marketing will certainly be facilitated by the Web. What is it about the Web that makes it such a powerful tool for niche marketing?

-

Determine which type of hedge instrument combination is most appropriate for Riveras situation. Justify your selection. Assume Riveras portfolio was perfectly hedged. It is now time to rebalance the...

-

The slippage does not occur in the belt drive of ____ cross-section.

-

Bell Farm and Garden Equipment reported the following information for 2010: Net Sales of Equipment $2,450,567 Other Income 6,786 Cost of Goods Sold 1,425,990 Selling, General, and Administrative...

-

Required: 2. After all of the transactions for the year ended December 31, 2015, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows...

-

Stalberg Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: There are 10 units of inventory on hand on December 31. 1. Calculate the total...

-

Select the best choice from among the possible answers given. Amortizing the discount on bonds payable a. Increases the recorded amount of interest expense. b. Reduces the semiannual cash payment for...

-

Refer to Apple Inc.s consolidated financial statements in Appendix A and online in the filings section of www.sec.gov. Requirements 1. Examine Note 5Income Taxesin the Notes to Consolidated Financial...

-

On May 31, 2015, top management of Stafford Manufacturing Co. decided to dispose of an unprofitable business component. An operating loss of $210,000 associated with the component was incurred during...

-

Although most firms that have a customer advisory board set them up after their firm is started, primarily to assess customer satisfaction and brainstorm new product ideas, customer advisory boards...

-

d.light, the subject of Case 4.2, is a for-profit social enterprise. What, if any, special factors should be kept in mind when writing a business plan for a for-profit social enterprise? Case 4.2...

-

Imagine you just received an e-mail message from a friend. The message reads, Just wanted to tell you that I just finished writing my business plan. Im very proud of it. Its very comprehensive and is...

-

Suppose you are asked to serve as a judge for a local business plan competition. In preparing for the competition, the organizer has asked you to write a very brief article titled What the Judges of...

-

LOral markets 32 brands of cosmetics, fragrances, and hair care products in 130 countries. The companys international strategy involves manufacturing these products in 42 plants located around the...

-

Light waves with two different wavelengths, 632 nm and 474 nm, pass simultaneously through a single slit whose width is 7.15 10-5 m and strike a screen 1.20 m from the slit. Two diffraction patterns...

-

Solve each problem. Find the coordinates of the points of intersection of the line y = 2 and the circle with center at (4, 5) and radius 4.

-

Journal entries for prepaid rent ABB Group (ABB), headquartered in Switzerland, is one of the worlds largest engineering companies. ABB applies U.S. GAAP, and reports its results in millions of U.S,...

-

Journal entries for borrowing Sappi Limited, a South African paper company, reports non-current Interest-Bearing Borrowings of $1,634 million at September 30, 2006. Sappi Limited applies IFRS, and...

-

Journal entries related to the income statement. Toyota Motor Company (Toyota), the Japanese car manufacturer, reported Sales of Products of 22,670 billion for the year ended March 31, 2007. The Cost...

-

Jamie Lee is attracted to the low monthly payment advertised for a vehicle lease. She may well be able to afford a more expensive car than she originally thought. Jamie Lee really needs to think this...

-

Explain virtual hosting and how to use either name-based or IP-based virtual hosting.?

-

Discuss the role of literary allusion in satire as a means of subverting conventions and critiquing societal norms.

Study smarter with the SolutionInn App