Alfalfa Companys functional currency is the dollar. On 30 June 20x1, it entered into a forward exchange

Question:

Alfalfa Company’s functional currency is the dollar. On 30 June 20x1, it entered into a forward exchange contract to purchase FC 100,000 at the forward rate of $1.077 for delivery on 30 June 20x2. The spot exchange rate was

$1.072. It designated the forward exchange contract as a hedging instrument in a cash flow hedge of a forecast transaction to purchase commodity on 31 March 20x2 and the resulting payable was to be paid on 30 June 20x2.

All hedge accounting conditions in IFRS 9 were met. The purchase of the commodity occurred on 31 March 20x2 as expected.

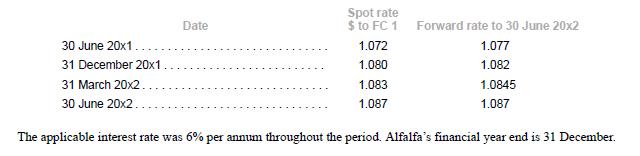

The following exchange rates apply for the period to 30 June 20x2.

Required

1. Show the journal entries if the hedging relationship is designated as being for changes in the fair value of the entire forward exchange contract and Alfalfa’s accounting policy is to adjust the cost of non-financial assets that result from hedged forecast transaction (hint: IFRS 9 allows the expected cash flows to be based on either spot rate or forward rate).

2. Show the journal entries if the hedging relationship is designated as being for changes in the spot element of the forward exchange contract and the interest element is excluded from the designated hedging relationship (IFRS 9: 6.5.16), and Alfalfa’s accounting policy is to adjust the cost of non-financial assets that result from hedged forecast transaction.

3. Is there any difference in the financial statements between (1) and (2) above?

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah