Lexco Companys functional currency is the dollar. On 1 December 20x1, Lexco entered into a four-month forward

Question:

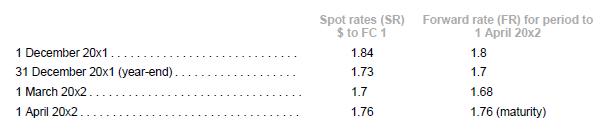

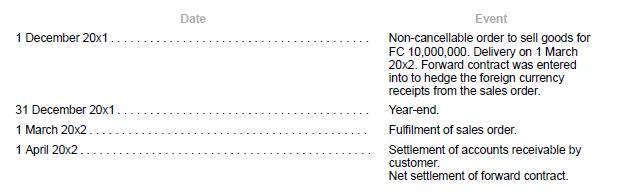

Lexco Company’s functional currency is the dollar. On 1 December 20x1, Lexco entered into a four-month forward contract to sell FC (foreign currency) units. Terms of the contract are as follows:

Required

1. Prepare the journal entries from 1 December 20x1 to 1 April 20x2 applying the requirements of IFRS 9 and IAS 21. The purpose of the forward contract is to hedge the foreign exchange risk; the interest element in the forward contract is excluded from the hedging relationship. The forward contract is designated as a cash flow hedge of the commitment and the resultant receivable. Assume all other requirements for hedge accounting are met.

2. How will the journal entries differ if the forward contract is accounted for as a fair value hedge?

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah