An US parent company with functional and presentation currency of US$ acquired 35% of a Singapore joint

Question:

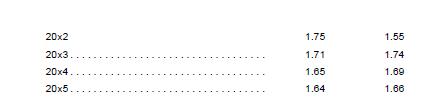

An US parent company with functional and presentation currency of US$ acquired 35% of a Singapore joint venture on 31 December 20x2 at cash consideration of S$800,000. The fair value of the net identifiable assets of the joint venture at the date of acquisition was S$710,000 and the exchange rate at the date of acquisition was 1.55.

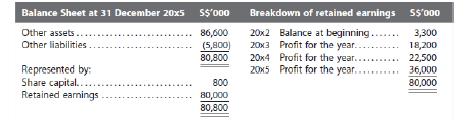

On 31 December 20x5, 15% of the interests in the Singapore joint venture with balance sheet in S$ as set out below was disposed for cash consideration of US$4,000,000.

The relevant exchange rates are also set out as follows.

Calculate the gain or loss on disposal, and prepare the accounting entries in the separate and consolidated financial statements. Assume that the US parent company has other subsidiaries and it prepares both consolidated and separate financial statements. Ignore tax effects.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah