On 1 March 20x3, ABC Corporation, whose functional currency is the dollar, was informed that it had

Question:

On 1 March 20x3, ABC Corporation, whose functional currency is the dollar, was informed that it had been successful in its tender for a contract to supply plant and equipment to an overseas customer. ABC Corporation’s tender price for the contract was FC 500,000. However, the contract would only be signed on 1 June 20x3 as there were certain technical details to be agreed upon. The delivery date was 31 December 20x3. Since the customer had indicated that it would give ABC Corporation a bank guarantee for the entire contract sum, ABC Corporation agreed to have the entire sum settled on 28 February 20x4. The equipment was delivered on schedule and the amount was settled on the due date.

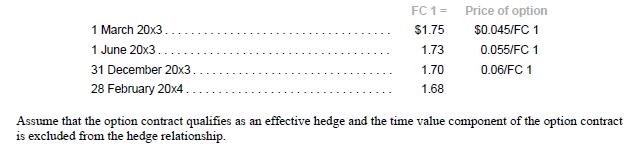

In anticipation of the signing of the contract, ABC Corporation purchased a put option contract with a notional amount of FC 500,000 on 1 March 20x3. The option, which had an exercise price of $1.75/FC 1, expired on 28 February 20x4. ABC Corporation paid a premium of $0.045 per FC 1 for the option. The purchase of the put option was to hedge the foreign exchange risk of the forecasted transaction on 1 March 20x3 and the resulting receivable after the transaction materializes. The spot exchange rates between the dollar and the FC, and the price of a 28 February 20x4 put option are as follows:

Required

1. What is the price of the option on 28 February 20x4?

2. Show all journal entries (with narratives) relating to the hedge from 1 March 20x3 to 28 February 20x4.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah