Company B paid cash consideration amounting to ($250),000 to Company A in exchange for 100% interests held

Question:

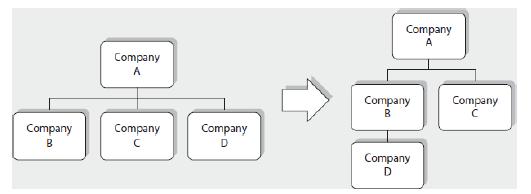

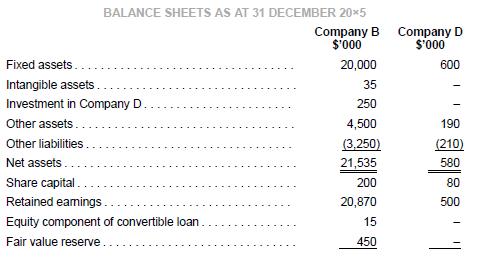

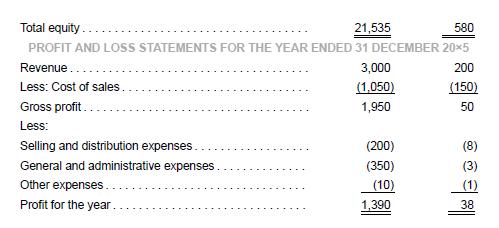

Company B paid cash consideration amounting to \($250\),000 to Company A in exchange for 100% interests held by Company A in the paid up capital of Company D on 1 January 20x5. Company D was previously acquired by Company A three years ago and at the date of acquisition then, goodwill arising from acquisition amounted to \($80\),000. Intangible asset relating to customer relationship was also recognized in the consolidated financial statements of Company A. As at 1 January 20x5, the carrying value of the unamortized intangible asset amounted to \($3\),000 and customer relationship has remaining useful life of three years. Goodwill is not impaired as at 1 January and 31 December 20x5. All companies within the group meet the definition of business under IFRS 3. The financial year end of all the companies is 31 December and the extract of the financial statements of the combining entities stands is presented below.

Prepare the accounting entries and the consolidated financial statements for Company B, assuming that Company B elects to present the full year results for both the current year and prior year. Ignore the effects of taxes for this question.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah