Details of assets and liabilities of Company XYZ are as follows: (a) Fixed assets Depreciation is on

Question:

Details of assets and liabilities of Company XYZ are as follows:

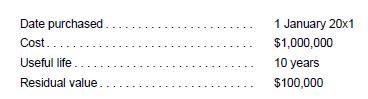

(a) Fixed assets

Depreciation is on a straight line basis. Capital allowances of $1,000,000 are recognized in full in 20x1. Recovery of residual value will be taxed when the fixed assets are disposed of.

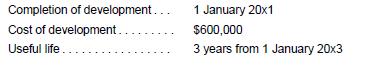

(b) Development expenditures

Development expenditures qualify as an asset under IAS 38 Intangible Assets and are not tax deductible.

Amortization is on a straight line basis.

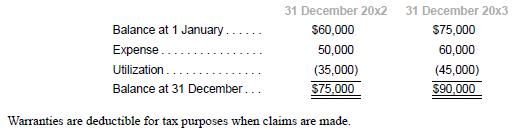

(c) Provision for warranties

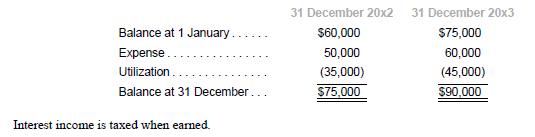

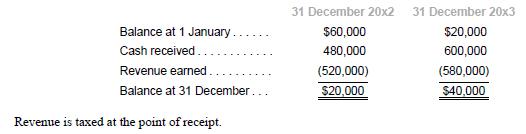

(d) Interest receivable

(e) Rental revenue received in advance

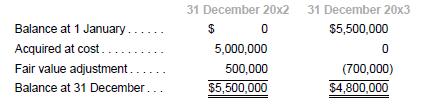

(f) Investment property

Investment property is carried at fair value. Changes in fair value are taken to Income Statement. Unrealized change in fair value is not taxed. Profit on sale is tax-exempt. Assume that the business model is to primarily hold the property to collect rents.

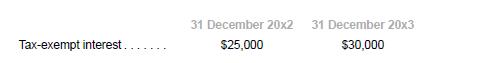

(g) Disallowed items included in net income

![]()

(h) Tax exemptions and reliefs granted

(i) Profit before tax

![]()

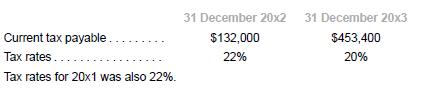

(j) Current tax payable and tax rates

Required

1. Using the balance sheet liability approach, and showing the carrying amount and the tax base for each asset and liability, determine the deferred tax liability (asset) balance as at 31 December 20x1, 31 December 20x2, and 31 December 20x3 for Company XYZ. Explain the tax base in each instance.

2. Determine the tax expense for 20x2 and 20x3.

3. Perform the analytical check on tax expense for 20x2 and 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah