During April 20x3, Small Ltd, a publicly listed company, agreed to issue 8.5 million new ordinary shares

Question:

During April 20x3, Small Ltd, a publicly listed company, agreed to issue 8.5 million new ordinary shares to the shareholders of Big Pte Ltd in exchange for 100% ownership of Big Pte Ltd. On 1 July 20x3, all parties to the agreement executed the share exchange.

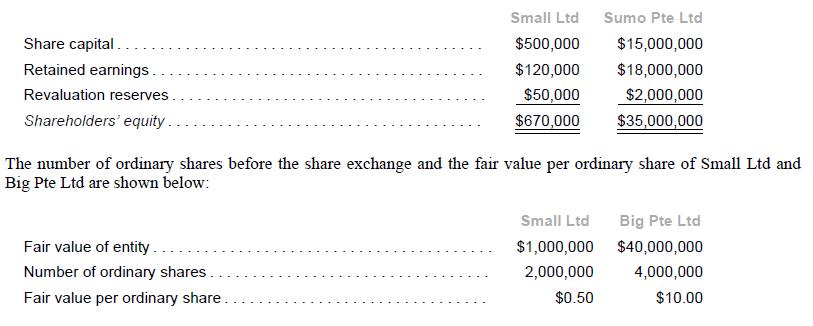

The shareholders’ equity of Small and Big immediately prior to the share exchange were as follows:

Provision for environmental damages During 20x2, Small Ltd was found to be guilty of breaching environmental laws. In the past, Small Ltd had publicly announced its policy of rectifying environmental damage caused by its operations. The outcome of the court judgment is unknown as at 1 July 20x3. Small disclosed this amount as a contingent liability in its separate financial statements. However, legal counsel had advised Small on the likelihood of the final settlement as follows:

The expected date of final settlement was 1 July 20x6. The cost of capital of Small Ltd was 10% per annum.

License contract Small had a non-cancellable contract to use the rights under a license for a period of ten years from 1 July 20x3.

The annual contracted license fee, payable at the start of the year, was $100,000 while the annual market license fee at the date of acquisition was $150,000. Small recognized the license fee as an expense as and when incurred.

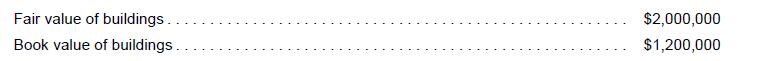

Identifiable net assets of Big Pte Ltd As at 1 July 20x3, the book value of Big’s identifiable net assets was close to fair value with the exception of the following:

The buildings had a remaining useful life of 20 years from 1 July 20x3. The tax rate was 20% throughout.

Required:

1. Assuming that the share exchange was in effect a reverse takeover (RTO), use the fair value of the acquirer’s shares to determine the fair value of consideration transferred by Big. (To facilitate comparability across answers, use at least four decimal points to determine ownership interest.)

2. Assuming the RTO scenario, prepare the consolidation adjustments for the year ended 31 December 20x3 with Big as the acquirer, to eliminate the investment in the subsidiary and to amortize the differences between the fair value and book value of identifiable net assets. Where there is a difference between the principal sum and the fair value for financial assets or liabilities, record the difference in an unamortized discount or premium account.

3. In July 20x6, the courts imposed a fine of $60,000 on Small.

(a) Show the entry to record the final settlement in Small’s books (no provision had been made previously for the fine).

(b) Show the consolidation adjustment to be made by Big during 20x6 with respect to the final settlement.

4. Should the acquirer recognize interest on the contract over the period of the lease? Why or why not?

5. Assuming that the share exchange was not a RTO and that the fair value of Small’s shares is reliable, prepare the consolidation adjustments for the year ending 31 December 20x3 with Small as the acquirer.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah