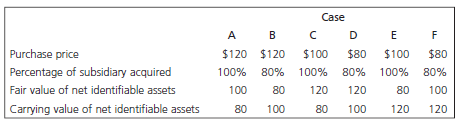

Question: Information relating to six independent cases has been provided below. Required Using the information provided for each case above, calculate: a. The gain from bargain

Required

Using the information provided for each case above, calculate:

a. The gain from bargain purchase, if present;

b. The net fair value adjustment;

c. The fair value adjustment allocated to net identifiable assets; and

d. The goodwill.

Case A Purchase price Percentage of subsidiary acquired Fair value of net identifiable assets Carrying value of net identifiable assets $120 $120 $100 100% 80% 100% 80% 100% 80% 80 $100 $80 $80 120 100 80 120 80 100 100 80 80 80 100 120 120

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Fair value of percentage acquired 100 64 120 96 80 80 Is there a gain from a bargain purchase N... View full answer

Get step-by-step solutions from verified subject matter experts