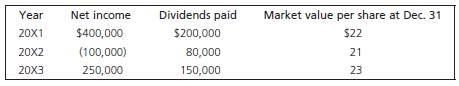

Jaguar Company purchased 25,000 common shares (20 percent) of Panther Company on January 1, 20X1, for $500,000.

Question:

On December 31, 20X3, Jaguar Company sold its investment in Panther Company for $575,000.

Required

1. Compute the balance in the investment account at the end of 20X1 assuming that the investment is classified as:

i. an FVTPL investment;

ii. an investment in an associate; and

iii. a FVTOCI investment.

2. Calculate how much total income will be reported in net income and OCI by Jaguar in relation to its investment in Panther in 20X1, 20X2, and 20X3, respectively, assuming the investment is classified as:

i. a FVTPL investment;

ii. an investment in an associate; and

iii. a FVTOCI investment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: