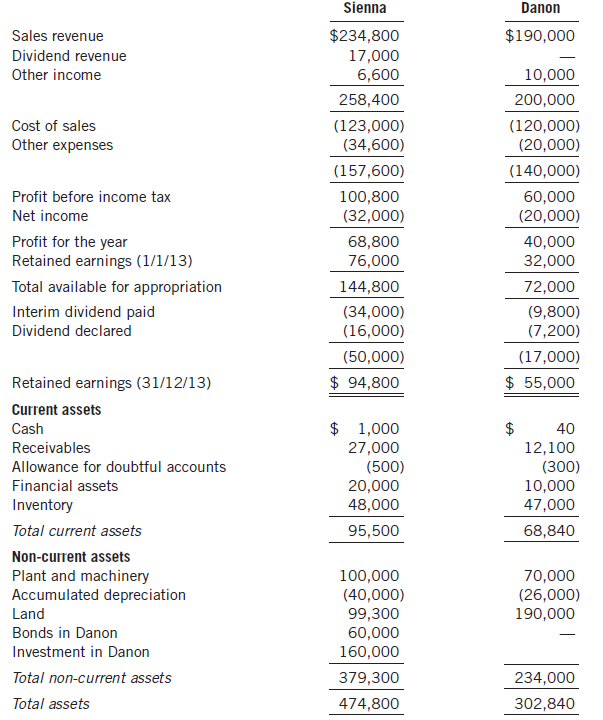

On January 1, 2013, Sienna acquired all the shares of Danon for $160,000. The financial statements of

Question:

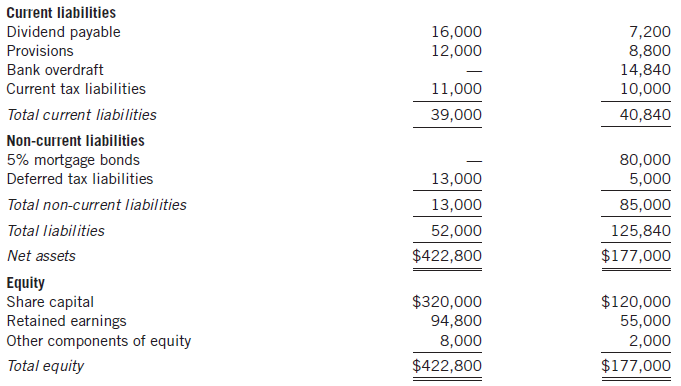

On January 1, 2013, Sienna acquired all the shares of Danon for $160,000. The financial statements of the two entities at December 31, 2013, contained the following information:

Additional information:

1. At January 1, 2013, all identifi able assets and liabilities of Danon were recorded at fair value except for inventory, for which the fair value was $1,000 greater than the carrying amount. This inventory was all sold by December 31, 2013. At January 1, 2013, Danon had research and development outlays that it had expensed as incurred. Sienna measured the fair value of the in-process research and development at $8,000. By December 31, 2013, it was assessed that $2,000 of this was not recoverable. At January 1, 2013, Danon had reported a contingent liability relating to a guarantee that was considered to have a fair value of $7,000. This liability still existed at December 31, 2013. At January 1, 2013, Danon had not recorded any goodwill.

2. The bonds were issued by Danon at par value on January 1, 2012, and are redeemable on December 31, 2016. Sienna acquired its holding ($60,000) of these bonds when Danon initially issued them. All interest has been paid and refl ected in the records of both entities.

3. During 2013, Sienna sold inventory to Danon for $40,000, at a markup of cost plus 25%. At December 31, 2013, $10,000 worth of inventory was still held by Danon.

4. On June 30, 2013, Danon sold land to Sienna. Sienna paid $30,000 for this land, with Danon having a cost of $24,000.

5. The Other Components of Equity account relates to fi nancial assets, for which an election under IFRS 9 was taken. For 2013, Sienna recorded an increase in these assets of $3,000, and Danon recorded a decrease of $2,000.

6. The income tax rate is 40%.

Required

Prepare the consolidated fi nancial statements for Sienna and its subsidiary for the year ended December 31, 2013.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer: