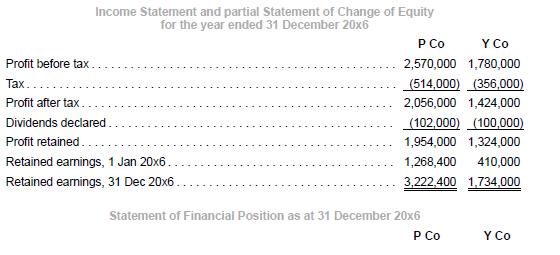

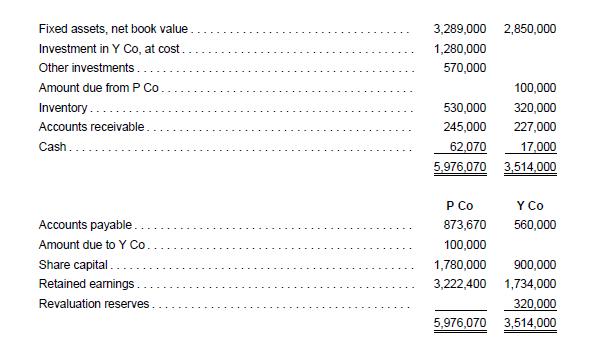

P Co acquired a controlling interest in Y Co on 1 January 20x4. The financial statements of

Question:

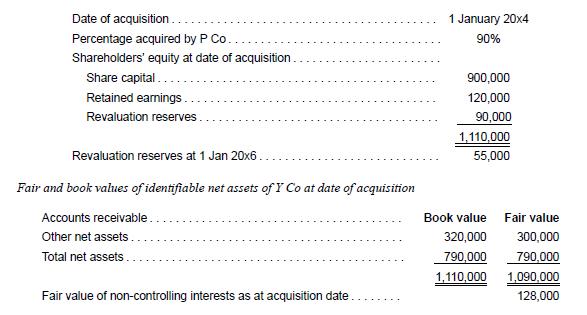

P Co acquired a controlling interest in Y Co on 1 January 20x4. The financial statements of P Co and Y Co and other relevant details are shown below. All figures are in dollars, unless as otherwise indicated.

Additional information

1. At acquisition date, Y Co had not made a provision for impairment loss of $20,000 on one of its debtors, Company Z. P Co, on acquisition of Y Co, had made the provision in its consolidated financial statements in accordance with the acquisition method in IFRS 3. On 31 December 20x5, the evidence confirmed that there was an actual impairment loss of $30,000 on the amount due from Company Z. Both Y Co and the Group made the appropriate adjustments. No further losses were expected thereafter.

2. On 1 January 20x6, Y Co sold equipment to P Co at a transfer price of $300,000. The original cost of the equipment was $345,000 and the accumulated depreciation at the date of transfer was $115,000. Residual value was negligible. The original useful life of the equipment was six years and the remaining useful life as at the date of transfer was four years.

3. On 1 November 20x6, Y Co sold inventory to P Co at transfer price of $130,000. The carrying amount in Y Co’s books was $90,000. Seventy percent remained unsold as at 31 December 20x6.

4. Tax rate was 20% throughout. Recognize tax effects on fair value adjustments.

Required

(a) Prepare consolidation adjusting entries for the year ended 31 December 20x6.

(b) Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6.

(c) Perform an analytical check on the balance of consolidated retained earnings as at 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah