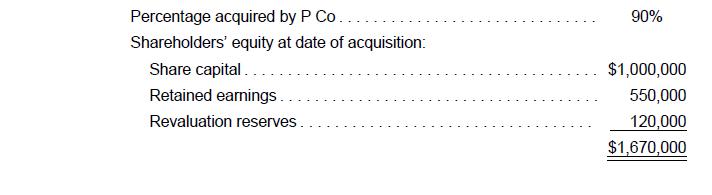

P Co acquired a controlling interest in Y Co on 1 January 20x4 as follows: Additional information

Question:

P Co acquired a controlling interest in Y Co on 1 January 20x4 as follows:

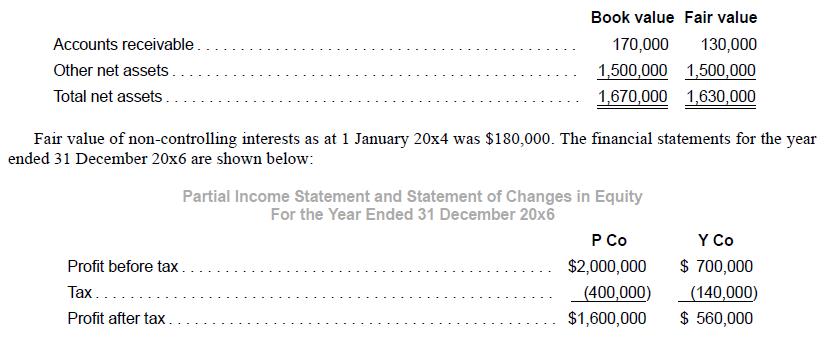

Additional information

(a) During 20x5, Y Co expensed off impairment loss so that the troubled receivables at acquisition date were written down to the recoverable amount of $130,000. No further losses were expected thereafter.

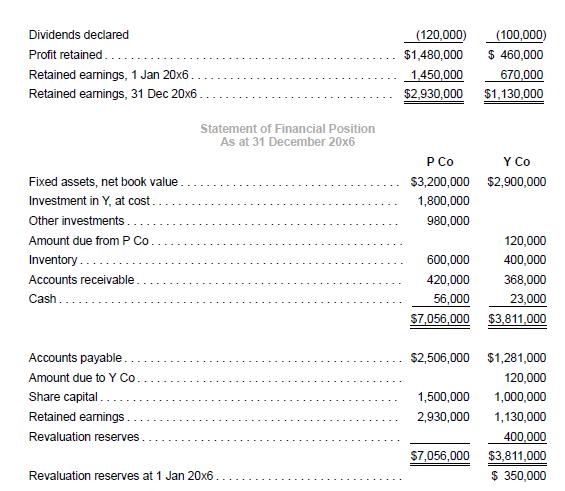

(b) On 1 January 20x6, Y Co sold equipment to P Co at a transfer price of $250,000. The original cost of the equipment was $300,000 and the accumulated depreciation at the date of transfer was $112,500. Residual value was negligible. The original useful life of the equipment was eight years and the remaining useful life as at the date of transfer was three years.

(c) On 1 November 20x6, P Co sold inventory to Y Co at fair value of $80,000. The carrying amount in P Co’s books was $70,000. Forty percent remained unsold as at 31 December 20x6. The fair value of the remaining inventory as at 31 December 20x6 was $30,000.

(d) Tax rate was 20% throughout. Recognize tax effects on fair value adjustments.

Required

1. Prepare consolidation entries for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IFRS 3 and IFRS 10.

2. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6, showing the workings clearly.

3. Perform an analytical check on the following consolidated amounts. Show workings clearly. (Derive the consolidated balance through a compilation of relevant entries and analytically check this number through an independent and logical process):

a. Consolidated fixed assets as at 31 December 20x6

b. Consolidated inventory as at 31 December 20x6

c. Consolidated retained earnings as at 1 January 20x6

d. Consolidated retained earnings as at 31 December 20x6

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah