P Co acquired control of Jasper Co through acquisition of 90% in the voting rights of Jasper

Question:

P Co acquired control of Jasper Co through acquisition of 90% in the voting rights of Jasper Co on 1 July 20x2. A cash transfer of $2,000,000 was made to the former owners of Jasper Co. P Co elects to measure non-controlling interests at fair value on acquisition date. The fair value of non-controlling interests on 1 July 20x2 was $200,000.

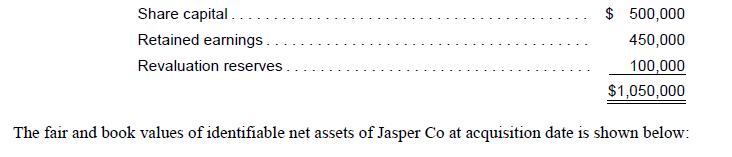

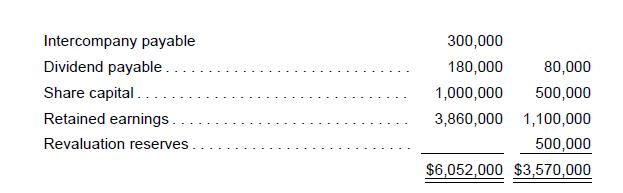

The shareholders’ equity of Jasper Co at acquisition date is as follows:

Required:

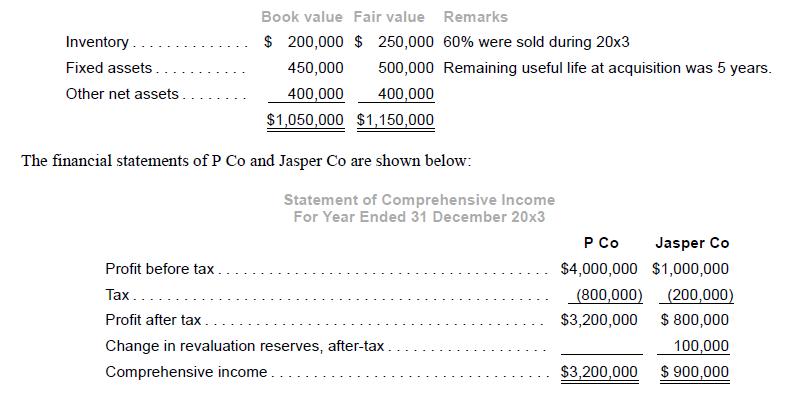

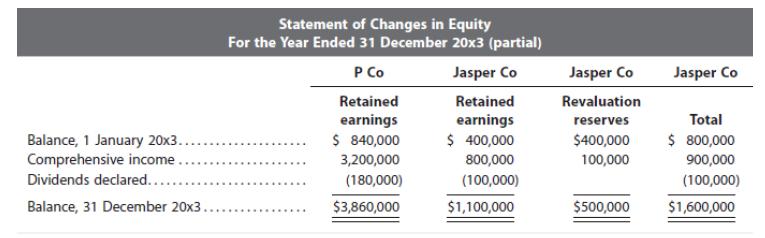

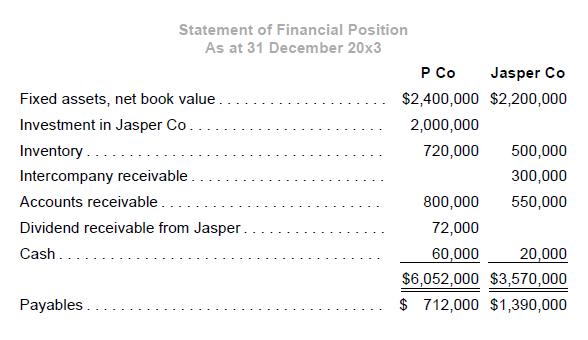

1. Prepare the consolidation adjusting entries for the year ended 31 December 20x3. Tax rate was 20%. Recognize tax effects on fair value differentials.

2. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x3.

Share capital.. Retained earnings. Revaluation reserves $ 500,000 450,000 100,000 $1,050,000 The fair and book values of identifiable net assets of Jasper Co at acquisition date is shown below:

Step by Step Answer:

To address the requirements well have to consolidate P Cos and Jasper Cos financial statements for the year ended 31 December 20x3 with the help of the information given Well focus on the adjusting en...View the full answer

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah

Students also viewed these Business questions

-

Assume the same facts as in P4.5, except that P Co elects to measure non-controlling interests as a proportion of identifiable net assets. Required: 1. Prepare the consolidation adjusting entries for...

-

On 1 January 20x4, P Co purchased a 90% interest in Topaz Co, a company that specializes in developing patented engineering processes. To acquire the controlling interest in Topaz Co, P Co...

-

On 1 January 20x1, P Co acquired 70% of S Co by issuing 1,000,000 new shares to the owners of S Co. The fair value of consideration paid by P Co to acquire S Co was $2,100,000. The fair value of...

-

An undamped mass spring system is released from rest from an initial displacement of x = 0.24 m and starts to oscillate. You see that the mass reaches its largest positive displacement for the first...

-

For the roof truss shown in Figure P3-48, use symmetry to determine the displacements of the nodes and the stresses in each element. All elements have E = 210 GPa and A = 10 10-4 m2. Figure P3-48 20...

-

Why must internal auditors be knowledgeable about the FCPA?

-

a. Begin with the data from \(n=185\) countries throughout the world that have valid (nonmissing) life expectancies. Plot the life expectancy versus the gross domestic product and private...

-

Use the Internet to locate www.cia.gov and www.Amazon.com. Find the privacy and security policies for each. Compare and contrast the use of privacy statements, encryption, SSL, and cookie policies.

-

Identify any five stakeholders who would be interested in Grassland s financial information and explain why and how each would use the information.

-

P Co acquired a controlling interest in Moonstone as follows: P Co chose to measure non-controlling interests at fair value on acquisition date. The fair value of non-controlling interests in...

-

On 1 January 20x4, P Co acquired 90% of S Co. Details of S Co as at the date of acquisition are as follows: Remaining useful life for the fixed assets as at acquisition date was five years and...

-

Test the series for convergence or divergence. 1 2 1 3 1 4 1 5 + 1 6

-

Returning to the Shipbreakers content, do these people have the choice to work in the shipyards? Or rather, do they have the freedom to leave given the logisticalconstraints of their lives? What does...

-

Develop a minimum one-page report, written in first-person, past tense, chronological order that includes the following: Date, time, and location of the incident (use your creativity). The nature of...

-

Prepare for the inevitablethe day you do not know an answer. Sometimes, it feels embarrassing to ask questions at work. In the following situations, which questions are im-portant to ask at work, and...

-

A marketing firm is hiring 3 new employees. Their job duties entail developing new marketing plans and to appear at certain promotional events. After all the candidates are interviewed, the marketing...

-

You are a college senior, interning at a company that is about to celebrate its first anniversary in business and is throwing a big party for its employees, customers and suppliers. It will need 10...

-

1. Who should win? 2. One of the reasons the common law of most states has not forced a bystander to render aid has been the fear that a bystander would do an imperfect job and subject himself to...

-

Find the intercepts and then graph the line. (a) 2x - 3y = 6 (b) 10 - 5x = 2y

-

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissors net assets was equal to $370,000. Problem 2-25...

-

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissors net assets was equal to $370,000. Problem 2-25...

-

Paper Company acquired 100 percent of Scissor Companys outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissors net assets was equal to $370,000. Problem 2-25...

-

1. Can a search and seizure be reasonable if it is not authorized by a warrant? 2. Should illegally seized evidence be excluded from trial, even though it is conclusive proof of a persons criminal...

-

Google developed a cross-compiler from Java to JavaScript. Why did they do this? Does this mean that JavaScript is not good enought for developing advanced web apps? What cultural phenomenon occurred...

-

1. Discuss the various kinds of crime classifications. To what extent or degree are they distinguishable? 2. List the problems faced by todays police departments that were also present during the...

Study smarter with the SolutionInn App