P Co and T Co formed a special purpose entity Z with the sole purpose of acquiring

Question:

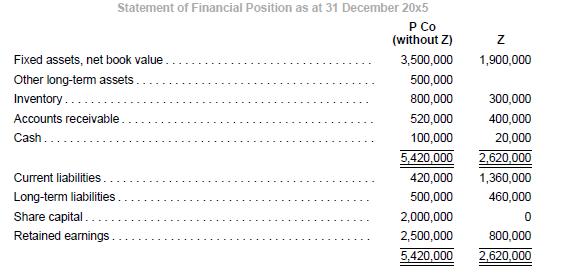

P Co and T Co formed a special purpose entity Z with the sole purpose of acquiring its output of extracted minerals. P Co and T Co agreed on the contractual sharing of power that required unanimous consent on all strategic activities of Z. P Co and T Co provided financial guarantees to lenders of Z. By virtue of its rights to the assets of Z and its obligations for the liabilities of Z, P Co is a joint operator of Z and recognizes its share of the assets and liabilities of Z on its statement of financial position. 20x5 is the first year of operations for Z.

Under the agreement, the sharing ratios are as follows:

Management fee is paid to P Co for being the manager on the project. Management fee is the difference between the share of equity and the share of net assets attributable to P Co. Ignore tax effects on management fees.

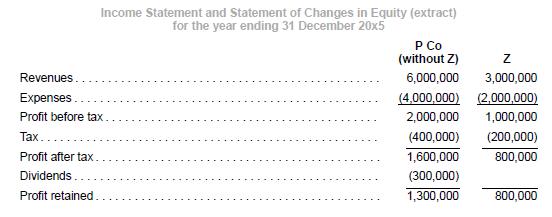

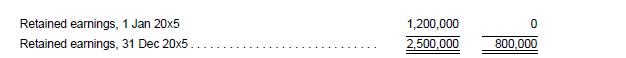

Prior to the finalization of accounts, the draft financial statements of P Co and Z for 20x5 are shown below:

Required

1. Prepare the journal entry to record the effects of the joint operations on P Co’s financial statements during 20x5.

2. Show the financial statements of P Co for the year ended 31 December 20x5 after incorporating the effects of the joint operations.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah