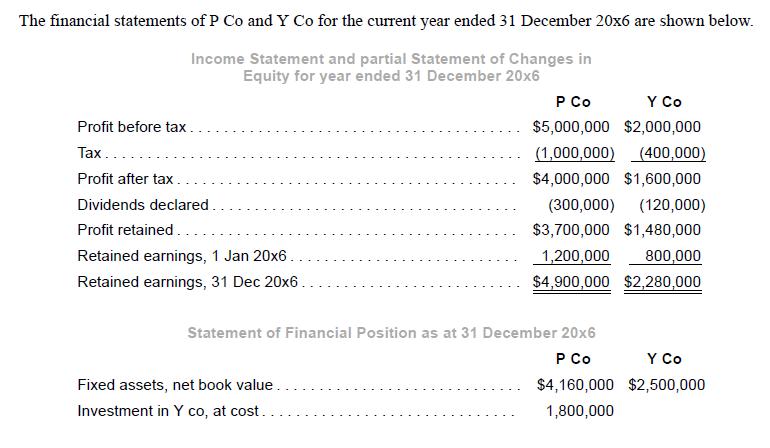

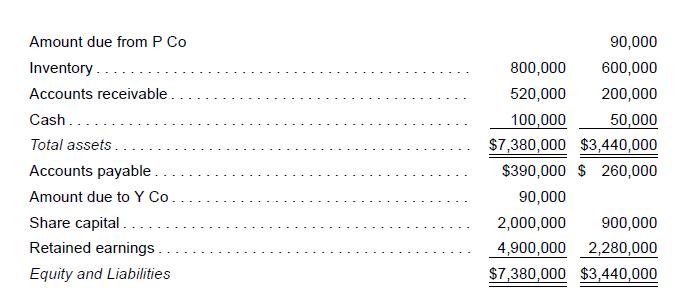

P Co obtained control of Y Co on 1 January 20x4 by acquiring a 90% interest in

Question:

P Co obtained control of Y Co on 1 January 20x4 by acquiring a 90% interest in Y Co. Share capital of Y Co was $900,000 and its retained earnings at date of acquisition was $300,000. Fair value of non-controlling interests of Y Co on 1 January 20x4 was $120,000.

Due diligence carried out before acquisition revealed that Y Co was a defendant in a litigation case in which a judgement was made in favor of the plaintiff. As Y Co is countersuing the plaintiff, no provision had yet been recognized as at 1 January 20x4 as the loss was not deemed probable. Based on expected losses, a provision of $200,000 should be recognized by P Co in accordance with IFRS 3. Y Co recognized a litigation expense of $180,000 in July 20x5 on the final award of damages to the plaintiff by the courts.

Required:

1. Prepare consolidation entries for the year ended 31 December 20x6.

2. Perform an analytical check on the balance in non-controlling interests as at 31 December 20x6, showing the workings clearly.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah