Porter Company purchased 60 percent ownership of Service Corporation on January 1, 20X1, at underlying book value.

Question:

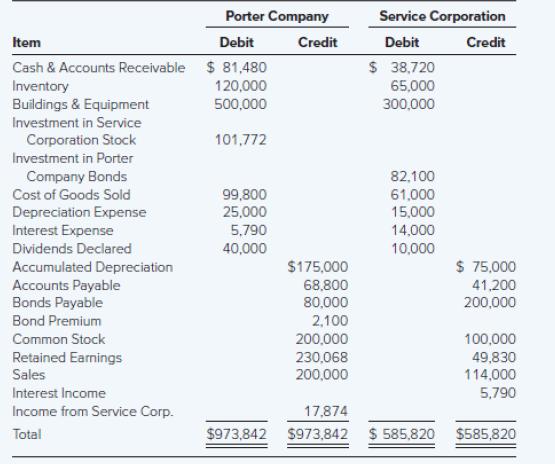

Porter Company purchased 60 percent ownership of Service Corporation on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Service’s book value. On January 1, 20X1, Porter sold $80,000 par value, 8 percent, five-year bonds directly to Service when the market interest rate was 7 percent. The bonds pay interest annually on December 31. Porter uses the fully adjusted equity method in accounting for its ownership of Service. On December 31, 20X2, the trial balances of the two companies are as follows:

Required

a. Record the journal entry or entries for 20X2 on Porter’s books related to its investment in Service.

b. Record the journal entry or entries for 20X2 on Porter’s books related to its bonds payable.

c. Record the journal entry or entries for 20X2 on Service’s books related to its investment in Porter’s bonds.

d. Prepare the consolidation entries needed to complete a consolidated worksheet for 20X2.

e. Prepare a three-part consolidated worksheet for 20X2.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd