Refer to P11.5. If the financial statements for 20x2 showed a pre-tax loss of $600,000 instead of

Question:

Refer to P11.5. If the financial statements for 20x2 showed a pre-tax loss of $600,000 instead of a profit of $750,000, what would be the journal entry for tax expense for 20x2? Assume that there is no reasonable assurance of future profitability and that the company will continue to be loss-making in the foreseeable future.

Data from P11.5

Co X was incorporated on 1 January 20x0. Details of assets and liabilities of Co X as at 31 December 20x1 were as follows:

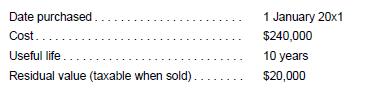

(a) Fixed assets

Depreciation is on a straight line basis. The capital allowances are as follows:

(i) $80,000 in 20x1 (ii) $80,000 in 20x2 (iii) $80,000 in 20x3

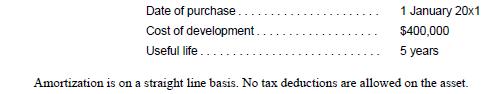

(b) Intangible asset

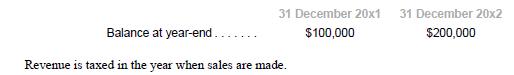

(c) Accounts receivable

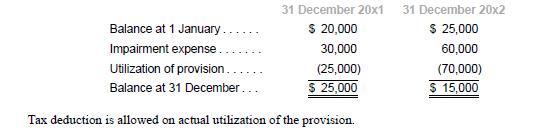

(d) Provision for impairment losses

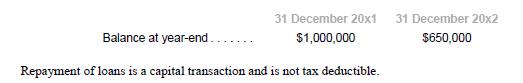

(e) Loan payable

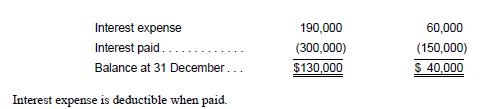

(f) Interest payable

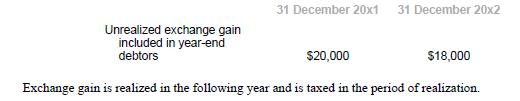

(g) Unrealized exchange gain

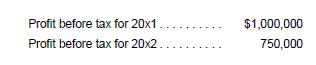

(h) Profit before tax

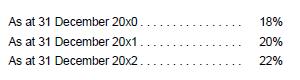

(i) Tax rates

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah