Sapphire Ltd, the company in P12.8 , reported the following net profit after tax for the year

Question:

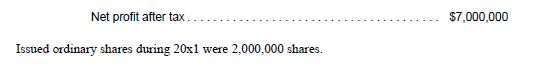

Sapphire Ltd, the company in P12.8 , reported the following net profit after tax for the year ended 31 December 20x1.

Required

1. Determine the basic earnings per share of Sapphire Ltd for the year ended 31 December 20x1, as reported in 20x1.

2. Determine the diluted earnings per share for the year ended 31 December 20x1, as reported in 20x1.

3. Show the restated comparative information for basic earnings per share and diluted earnings per share information for 20x1, as reported in the 20x2 financial statements.

4. When comparing the 20x2 earnings per share information with the restated comparatives, what inferences can you make about the profitability of Sapphire Ltd?

Data from P12.8

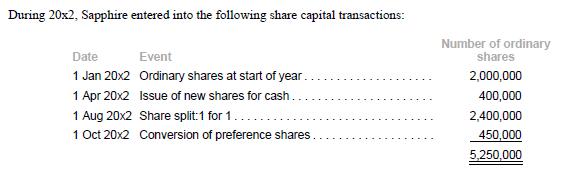

Sapphire Ltd has a complex capital structure that includes both ordinary shares and potential ordinary shares.

Sapphire Ltd reported the following net profit and dividends information for the current year ended 31 December 20x2.

The following information relates to potential ordinary shares issued by Sapphire Ltd:

(a) On 1 July 20x1, Sapphire issued 1,000,000 convertible preference shares at $1 per share. On 1 October 20x2, 450,000 preference shares were converted to ordinary shares. Under the issue agreement, the shares bear a tax exempt coupon rate of 6% on a non-cumulative basis. The dividends are paid on a pro-rated basis for the period that the shares are outstanding. Prior to the share split, the conversion ratio was two preference shares to one ordinary share. After the share split, the conversion ratio is on a one-to-one basis.

(b) On 31 December 20x2, Sapphire had 600,000 units of outstanding stock options. These options were issued on 1 April 20x2 and none were exercised during 20x2. Each stock option entitles the holder to purchase one ordinary share at the exercise price of $2.60 per share. The average market price for the period from 1 April 20x2 to 31 December 20x2 was $3.00 per share. All prices were adjusted for share splits.

(c) On 1 July 20x2, Sapphire issued convertible bonds. Under IAS 32, the bonds were recognized separately from the equity options. The fair value of the bonds was $6,000,000. Each dollar of bond was convertible to one ordinary share after adjustment for share split. There were no conversions in 20x2. The effective interest rate of the bonds was 5% per annum.

(d) Tax rate applicable to 20x2 was 20%. Preference dividends are tax-exempt.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah