St. John Corporation is barely solvent and has been seeking an equity investor that would be interested

Question:

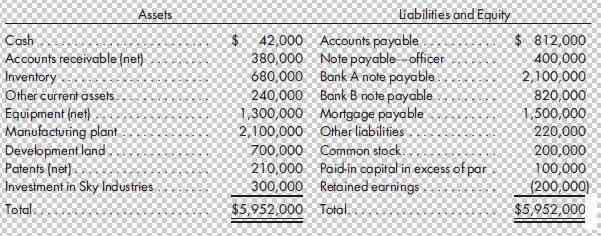

St. John Corporation is barely solvent and has been seeking an equity investor that would be interested in making a capital contribution so that the company would hopefully return to performance levels it had experienced in the past. At the end of the prior year, the company’s balance sheet was as follows:

Selected transactions occurring during the first six months of the current year were as follows:

a. Patents with a fair value of $230,000 were transferred to the officer in partial satisfaction of their note. The remaining balance on the note would be paid over five quarters with the first payment of $35,026.77 due on June 30 of the current year.

b. The mortgage payable was restructured with 40 quarterly payments of $51,178.05, beginning on June 30 of the current year, in addition to an immediate lump sum payment of $100,000.

c. The bank A note payable was restructured as follows: the development land with a net realizable value of $980,000 was conveyed along with marketable securities having a book value of $80,000 and a market value of $95,000. The balance of the note was to be over 10 quarters with payments of $111,145.03 beginning on June 30 of the current year.

d. The bank B note payable was partially secured by equipment which had a book value of $240,000 and a net realizable value of $220,000. The equipment was seized by the bank and the company agreed to settle the balance of the note by making 10 quarterly payments of $55,000 beginning on June 30 of the current year.

e. On June 30 of the current year all payments required by items (a) through (d) above were paid.

f. Common shareholders approved a reduction in par value from $10 per share to $5 per share and the deficit was eliminated.

Required

Prepare all necessary entries to record the above transactions (a) through (f ).

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng