The Hardy Company ceased operations in its Illinois plant on July 1. On August 1, it was

Question:

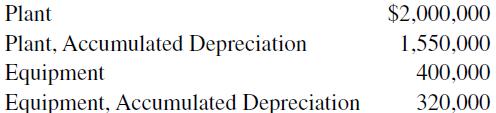

The Hardy Company ceased operations in its Illinois plant on July 1. On August 1, it was decided to dismantle the equipment and sell the plant. The cost of dismantling the equipment was $7,000. The equipment was sold as scrap, and second-hand equipment was sold for $20,000. The plant was sold for $120,000, and there were expenses of $6,000 connected with the sale. Depreciation was last accrued on the plant and equipment on the previous December 31. The January 1 balances in the plant and equipment accounts of the Illinois plant were as follows:

The building depreciation was $4,000 per month, and the equipment depreciation was $3,000 per month.

Prepare journal entries to record the depreciation for the period and also the retirement of the plant and equipment of the Illinois plant.

Step by Step Answer:

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman