You have been asked to evaluate several investment opportunities for the biotechnology company for which you work.

Question:

You have been asked to evaluate several investment opportunities for the biotechnology company for which you work.

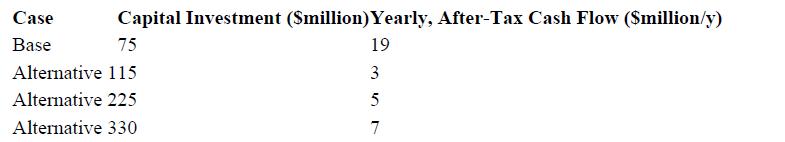

These potential investments concern a new process to manufacture a new, genetically engineered pharmaceutical. The financial information on the process alternatives are as follows:

For the alternatives, the capital investment and the yearly after-tax cash flows are incremental to the base case. The assumed plant life is 12 years, and all of the capital investment occurs at time = 0.

If an acceptable, nondiscounted rate of return on investment (ROROI) is 25% p.a., which is the best option?

If an acceptable, after-tax, discounted rate of return is 15% p.a., which option is the best?

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting