Winfred Metal Reclamation Ltd, a small company, buys scrap metal residues from local companies and treats the

Question:

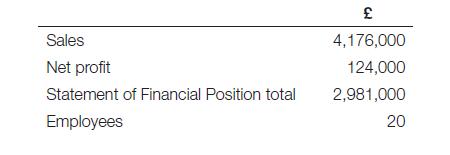

Winfred Metal Reclamation Ltd, a small company, buys scrap metal residues from local companies and treats the residues to recover the metal which is then sold to other local companies. The company is 75 per cent owned equally by Joe Winfred and his brother Eric, with their mother owning the remaining 25 per cent. The directors are Joe and Eric. The bank has advanced the company £0.5m for a new smelter. They have an audit at the insistence of the Bank but Eric is always complaining about the cost of it and thinks they don’t need one now they have the bank loan. Some purchases are made from itinerant scrap merchants. No evidence is available for the purchase of this scrap which totalled £160,000 in the year ending 30 November 20X6. However, there is no evidence that it is incorrect and Joe has had to give the auditors a letter giving them assurances over the completeness and validity of the transactions. The auditors find all other matters to be satisfactory and records are reasonable. Office staff consists of Mary and Susan, who deal with all accounting matters including wages between them. There is no formal split of responsibilities, they just do what needs doing when it needs doing. Mary is living with Eric. Some figures in the year ending 30.11.20X6 are:

Discussion

– Is it possible for this company to dispense with an audit? Is this a good idea?

– Can the company file abridged accounts? What should the auditor do if they do?

Step by Step Answer: