Waste Management, Inc.s Form 10-K filed with the Securities and Exchange Commission (SEC) on March 28, 1997

Question:

Waste Management, Inc.’s Form 10-K filed with the Securities and Exchange Commission (SEC) on March 28, 1997 described the company at that time as a leading international provider of waste management services. According to disclosures in the Form 10-K, the primary source of its business involved providing solid waste management services consisting of collection, transfer, resource recovery, and disposal services for commercial, industrial, municipal, and residential customers, as well as other waste management companies. As part of these services, the company provided paper, glass, plastic, and metal recycling services to commercial and industrial operations and curbside collection of such materials from residences. The company also provided services involving the removal of methane gas from sanitary landfill facilities for use in electricity generation and provided Port-O-Let portable sanitation services to municipalities, commercial businesses, and special event customers. In addition to solid waste management services, the company provided hazardous waste and other chemical removal, treatment, storage, and disposal services.

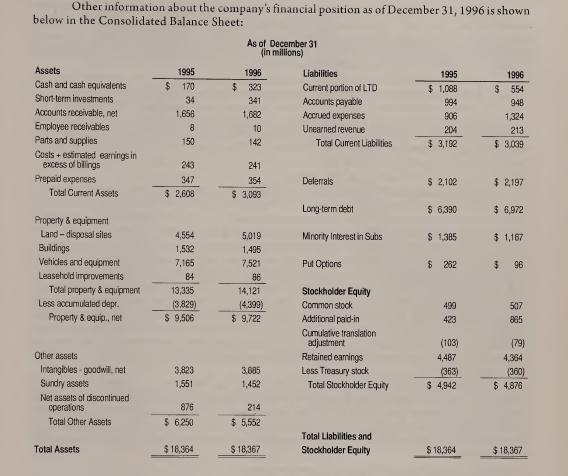

According to information in the Form 10-K, the Oak Brook, Illinois based company was incorporated in 1968. In 28 years of operations, the company had grown to be a leader in waste management services. For the year ended December 31, 1996, the company reported consolidated revenues of $9.19 billion, net income of $192 million, and total assets of $18.4 billion. The company’s stock, which traded around $36 per share in 1996, was listed on the New York Stock Exchange (NYSE), in addition to being listed on the Frankfurt, London, Chicago, and Swiss stock exchanges.

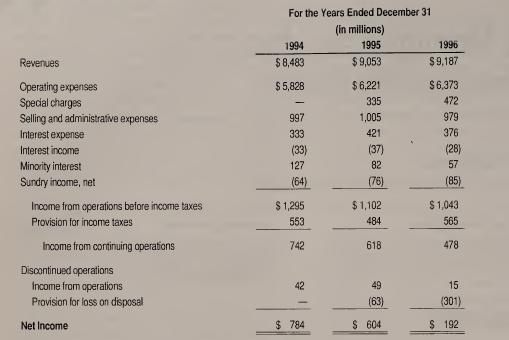

Despite being a leader in the industry, the 1996 financial statements revealed that the company was feeling pressures from the effects of changes that were occurring in its markets and in the environmental industry. Although consolidated revenues were increasing, the 1996 Consolidated Statement of Income showed decreasing net income, as summarized on the next page.

According to managements disclosures in the 1996 Form 10-K, Waste Management, Inc. was encountering intense competition, primarily in the pricing and rendering of services, from various sources in all phases of its waste management and related operations. In the solid waste collection phase, competition was being felt from national, regional, and local collection companies. In addition, the company was competing with municipalities and counties, which through the use of tax revenues were able to provide such services at lower direct charges to the customer than could Waste Management. Also, the company faced competition from some large commercial and industrial companies, which handled their own waste collection. In addition, the company encountered intense competition in pricing and rendering of services in its portable sanitation services business and its on-site industrial cleaning services business.

Management noted that the pricing, quality, and reliability of services and the type of equipment utilized were the primary methods of competition in the industry. Over half of the company’s assets as of December 31, 1995 and 1996 involved property and equipment, consisting of land (primarily disposal sites), buildings, vehicles and equipment, and leasehold improvements, with land and vehicles and equipment representing 20% and 27%, respectively, of the company’s total consolidated assets. Disposal sites included approximately 66,400 total acres, which had estimated remaining lives ranging from one to over 100 years based upon management’s site plans and estimated annual volumes of waste. The vehicles and equipment included approximately 21,400 collection and transfer vehicles, 1.6 million containers, and 25,100 stationary compactors. In addition, the Form 10-K stated that the company owned, operated or leased 16 trash-to-energy facilities, eight cogeneration and small power production facilities, two coal handling facilities, three biosolids drying, pelletizing and composting facilities, one wastewater treatment plant and various other manufacturing, office and warehouse facilities.

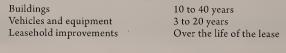

The accounting policies footnote in the 1996 financial statements disclosed that the cost of property and equipment, less estimated salvage value, was being depreciated over the estimated useful lives on the straight-line method as follows:

FRAUD REVEALED Before the 1997 annual financial statements were released, the company issued a press release on January 5, 1998 announcing that it would file amended reports on Form 10-K and 10-Q/or the year ended December 31, 1996 and for the three-month periods ended March 31, 1997 and June 30, 1997. The press release also disclosed management’s plans to revise certain previously reported financial data and to issue revised financial statements for 1994 and 1995 to reflect various revisions of various items of income and expense.........

REQUIRED [1] Three conditions are often present when fraud exists. First, management or employees have an incentive or are under pressure, which provides them a reason to commit the fraud act. Second, circumstances exist - for example, absent or ineffective internal controls or the ability for management to override controls - that provide an opportunity for the fraud to be perpetrated. Third, those involved are able to rationalize the fraud as being consistent with their personal code of ethics. Some individuals possess an attitude, character, or set of ethical values that allows them to knowingly commit a fraudulent act. Using hindsight, identify factors present at Waste Management that are indicative of each of the three fraud conditions: incentives, opportunities, and attitudes.

[2] Review Waste Management’s Consolidated Balance Sheet as of December 31, 1996. Identify accounts whose balances were likely based on significant management estimation techniques. Describe the reasons why estimates were required for each of the accounts identified.

[3] Describe why accounts involving significant management estimation are generally viewed as inherently risky.

[4] Review Auditing Standards (AU) Section 342, Auditing Accounting Estimates, and describe the auditor’s responsibilities for examining management-generated estimates. Also, AU Section 342 provides guidance to assist auditors in examining estimates. Describe the techniques commonly used by auditors to evaluate the reasonableness of management’s estimates.

[5] The Waste Management fraud primarily centered on inappropriate estimates of salvage values and useful lives for property and equipment. Describe techniques Andersen auditors could have used to assess the reasonableness of those estimates used to create Waste Management’s financial statements.

[6] Several of the Waste Management accounting personnel were formerly employed by the company’s auditor, Arthur Andersen. What are the risks associated with allowing former auditors to work for a client in key accounting positions? Research Section 206 of the Sarbanes-Oxley Act of 2002 and provide a brief summary of the restrictions related to the ability of a public company to hire accounting personnel who were formerly employed by the company’s audit firm.

[7] Discuss possible reasons why the Andersen partners allegedly allowed Waste Management executives to avoid recording the identified accounting errors. How could accounting firms ensure that auditors do not succumb to similar pressures on other audit engagements?

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 978-0132423502

4th Edition

Authors: Steven M Glover, Douglas F Prawitt