Modern Office Furnishings, Inc. (MOF) is a relatively small public company. Its stock is listed on the

Question:

Modern Office Furnishings, Inc. (MOF) is a relatively small public company. Its stock is listed on the NASDAQ national exchange. MOF manufactures and sells a limited variety of office furnishings such as desks, chairs, tables, and lamps, with particular emphasis on furniture that is computer compatible (e.g., desks designed to accommodate computer monitors, keyboards, and printers). The company negotiated a contract this year with Advanced Computer Systems to produce computer surge protectors (i.e., electronic devices that protect computer equipment from surges in electric current). This contract is the company's first attempt at electronics manufacturing. MOF markets its office furnishings through wholesale and discount retail businesses. Its largest customer is Wal-Mart Stores. All of its surge protectors are sold to Advanced Computer Systems.

The company began operations in 1979. At that time it was named Custom Furniture Company, and it sold household furnishings. In 1992 a group of venture capital investors acquired the company, changed its name and product lines, and sold 20 percent of its outstanding stock in an initial public offering. The initial public offering price was \(\$ 10\) per share. After trading as high as \(\$ 12\) per share, the stock has traded in a range of \(\$ 6\) to \(\$ 8\) per share for the last year. The venture capital group continues to control the company through control of the board of directors.

In the past two years, 1996 and 1997, the economy has been in a long recovery phase after the recession of 1994 and 1995. Gross National Product, the overall gauge of production of goods and services in the U. S. economy, rose by an inflation-adjusted 3 percent in 1997. Inflation, which was low in 1994 and 1995, was 5 percent in 1997, but this increase was not felt in the office furnishings industry. Industry sales tend to be dependent on new business startups, which in turn are affected by interest rates. Long-term interest rates have moved up slightly in the past six months.

A new chief executive officer, John Smith, was selected in February 1997. The previous CEO left because of a disagreement with the Board of Directors over the desirability of expanding into electronics manufacturing. The previous CEO opposed such expansion as too risky, but Smith, who at the time was vice president of marketing, supported the expansion. The expansion plans are presently being implemented. Smith has been with the company for three years. Prior to that he was a marketing manager for an advertising agency. The position of vice president of marketing was not filled because Smith will continue to perform that function. As part of his compensation package Smith was granted options to purchase 20,000 shares of stock at an option price of \(\$ 9\) per share. The option expires in five years. Additionally, Smith is eligible for a cash bonus of 3 percent of the excess of net income before taxes over \(\$ 3,000,000\).

The chief financial officer, Tracy Adamson, has been with the company only a short time. She was hired after the previous CFO resigned with the previous CEO. Prior to this, Adamson was employed as an accounting clerk with a local utility company. As part of her compensation package she was granted options to purchase 8,000 shares of stock at an option price of \(\$ 9\) per share. The option expires in five years.

Charles Pendley, vice president of production, is in charge of plant operations and has been with the company from its inception.

Mary Pinkerton, treasurer, supervises the deposits and disbursements of cash, custody of securities, and reconciliation of bank statements. Pinkerton has been treasurer for two years.

Required:

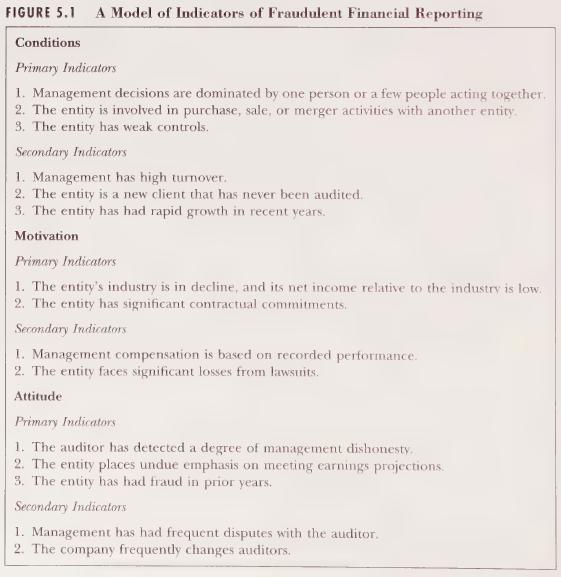

Refer to Figure 5.1 in the text. Give as many examples as you can of indicators of fraudulent financial reporting. Give reasons for your examples.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor