Sorenson Manufacturing Corporation was incorporated on January 3, 2022. The corporations financial statements for its first years

Question:

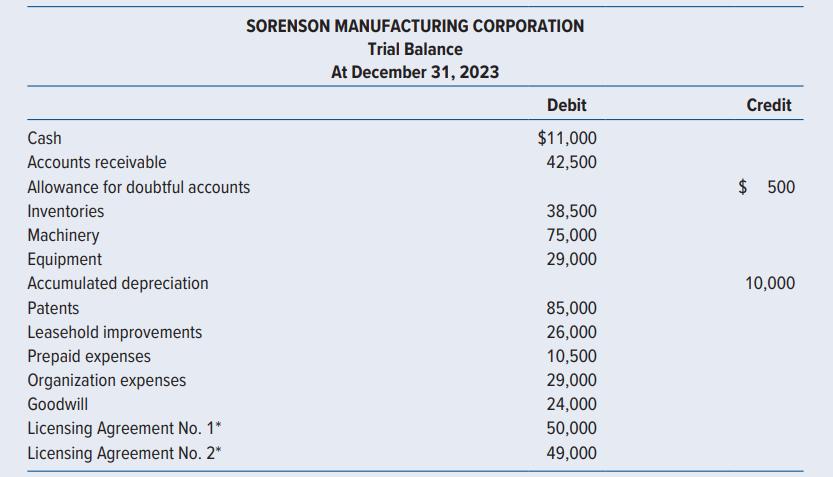

Sorenson Manufacturing Corporation was incorporated on January 3, 2022. The corporation’s financial statements for its first year’s operations were not examined by a CPA. You have been engaged to audit the financial statements for the year ended December 31, 2023, and your work is substantially completed. A partial trial balance of the company’s accounts follows:

The following information relates to accounts that may yet require adjustment:

1. Patents for Sorenson’s manufacturing process were purchased January 2, 2023, at a cost of $68,000. An additional $17,000 was spent in December 2023 to improve machinery covered by the patents and charged to the Patents account. The patents had a remaining legal term of 17 years.

2. On January 3, 2022, Sorenson purchased two licensing agreements; at that time they were believed to have unlimited useful lives. The balance in the Licensing Agreement No. 1 account included its purchase price of $48,000 and $2,000 in acquisition expenses. Licensing Agreement No. 2 also was purchased on January 3, 2022, for $50,000, but it has been reduced by a credit of $1,000 for the advance collection of revenue from the agreement.

3. In December 2022, an explosion caused a permanent 60 percent reduction in the expected revenue-producing value of Licensing Agreement No. 1, and in January 2023, a flood caused additional damage, which rendered the agreement worthless.

4. A study of Licensing Agreement No. 2 made by Sorenson in January 2023 revealed that its estimated remaining life expectancy was only 10 years as of January 1, 2023.

5. The balance in the Goodwill account includes $24,000 paid December 30, 2022, for an advertising program, which it is estimated will assist in increasing Sorenson’s sales over a period of four years following the disbursement.

6. The Leasehold Improvement account includes

(a) The $15,000 cost of improvements with a total estimated useful life of 12 years, which Sorenson, as tenant, made to leased premises in January 2022;

(b) Movable assembly-line equipment costing $8,500, which was installed in the leased premises in December 2023;

(c) Real estate taxes of $2,500 paid by Sorenson, which, under the terms of the lease, should have been paid by the landlord. Sorenson paid its rent in full during 2023. A 10-year nonrenewable lease was signed January 3, 2022, for the leased building that Sorenson used in manufacturing operations.

7. The balance in the Organization Expenses account includes preoperating costs incurred during the organizational period.

Required:

For each of the items 1–7

a. Prepare adjusting entries as necessary.

b. Identify the substantive audit procedures you would perform to test the transactions.

Step by Step Answer:

Auditing And Assurance Services

ISBN: 9781266796852

9th Edition

Authors: Timothy Louwers, Penelope Bagley, Allen Blay, Jerry Strawser, Jay Thibodeau