A Bell has kept records of his business transactions in a single entry form, but he did

Question:

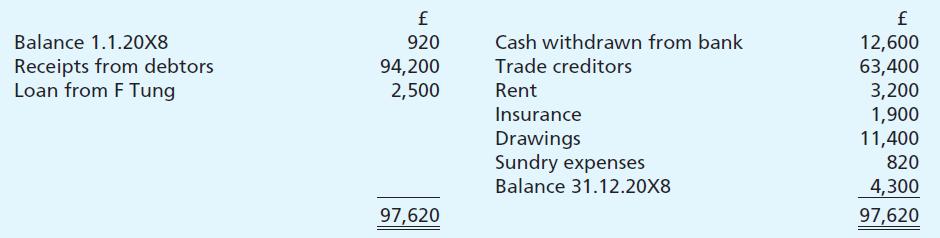

A Bell has kept records of his business transactions in a single entry form, but he did not realise that he had to record cash drawings. His bank account for the year 20X8 is as follows:

Records of cash paid were: Sundry expenses £180; Trade creditors £1,310. Cash sales amounted to £1,540.

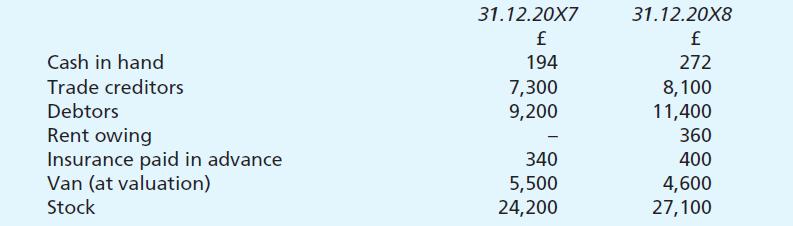

The following information is also available:

You are to draw up a trading and profit and loss account for the year ended 31 December 20X8, and a balance sheet as at that date. Show all of your workings.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted: