In recent years, Khang Plc has earned a reputation for buying modestly performing businesses and selling them

Question:

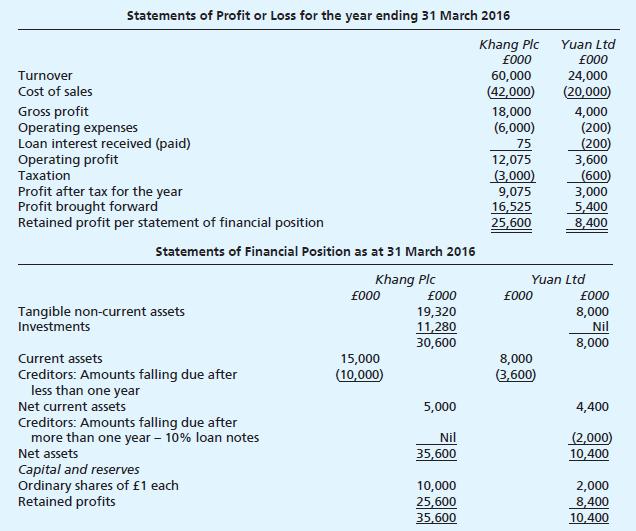

In recent years, Khang Plc has earned a reputation for buying modestly performing businesses and selling them at a substantial profit within a period of two to three years of their acquisition. On 1 July 2015, Khang Plc acquired 80% of the ordinary share capital of Yuan Ltd at a cost of £10,280,000. On the same date, it also acquired 50% of Yuan Ltd’s 10% loan notes at par. The summarised draft financial statements of the two companies are:

The following information is relevant:

1 The fair values of Yuan Ltd assets were equal to their book values with the exception of its plant, which had a fair value of £3.2 million in excess of its book value at the date of acquisition. The remaining life of all of Yuan Ltd’s plant at the date of its acquisition was four years and this period has not changed as a result of the acquisition. Depreciation of plant is on a straight-line basis and charged to cost of sales. Yuan Ltd has not adjusted the value of its plant as a result of the fair value exercise.

2 Khang Plc bears almost all of the administration costs incurred on behalf of the group (invoicing, credit control, etc). It does not charge Yuan Ltd for this service as to do so would not have a material effect on the group profit.

3 Revenues and profits should be deemed to accrue evenly throughout the year.

4 The goodwill impairment review at the year-end found goodwill to be overstated by £300,000.

Required:

Prepare a consolidated statement of profit or loss and statement of financial position for Khang Plc for the year to 31 March 2016.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster