The accounting records of the Happy Tickers Sports and Social Club are in a mess. You manage

Question:

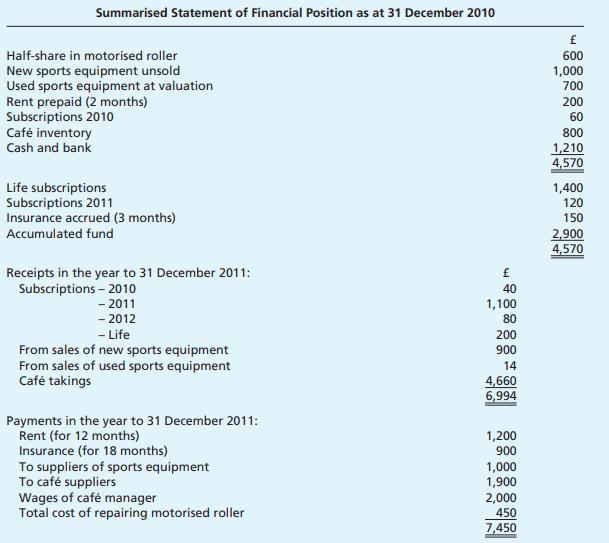

The accounting records of the Happy Tickers Sports and Social Club are in a mess. You manage to find the following information to help you prepare the accounts for the year to 31 December 2011.

(i) Ownership and all expenses of the motorised roller are agreed to be shared equally with the Carefree Conveyancers Sports and Social Club which occupies a nearby site. The roller cost a total of £2,000 on 1 January 2009 and had an estimated life of 10 years. (ii) Life subscriptions are brought into income equally over 10 years, in a scheme begun 5 years ago in 2008. Since the scheme began the cost of £200 per person has been constant. Prior to 31 December 2010 10 life subscriptions had been received. (iii) Four more annual subscriptions of £20 each had been promised relating to 2011, but not yet received. Annual subscriptions promised but unpaid are carried forward for a maximum of 12 months. (iv) New sports equipment is sold to members at cost plus 50%. Used equipment is sold off to members at book valuation. Half the sports equipment bought in the year (all from a cash and carry supplier) has been used within the club, and half made available for sale, new, to members. The ‘used equipment at valuation’ figure in the 31 December 2011 statement of financial position is to remain at £700. (v) Closing café inventory is £850, and £80 is owed to suppliers at 31 December 2011.

Required:

(a) Calculate the profit on café operations and the profit on sale of sports equipment.

(b) Prepare a statement of subscription income for 2011.

(c) Prepare an income and expenditure statement for the year ending 31 December 2011, and statement of financial position as at 31 December 2011.

(d) Why do life subscriptions appear as a liability?

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan