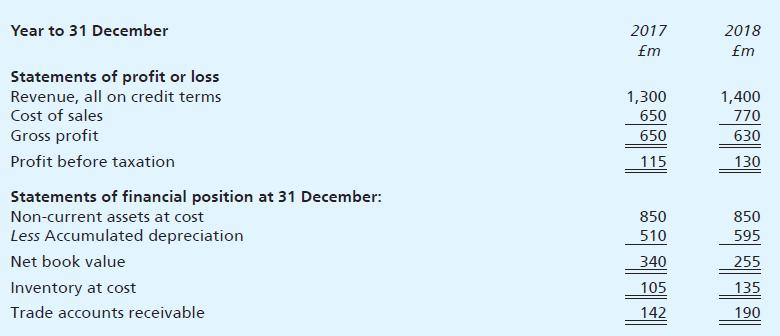

You are presented with the following information relating to Messiter plc: Required: (a) Using the historical cost

Question:

You are presented with the following information relating to Messiter plc:

Required:

(a) Using the historical cost financial statements and stating the formulae you use, calculate the following accounting ratios for both 2017 and 2018:

(i) Gross profit percentage;

(ii) Net profit percentage;

(iii) Inventory turnover, stated in days;

(iv) Trade accounts receivable collection period, stated in days; and

(v) Non-current asset turnover.

(b) Using the following additional information:

(i) Restate the turnover for 2017 and 2018 incorporating the following average retail price indices:

(ii) Calculate the additional depreciation charge required to finance the replacement of noncurrent assets at their replacement cost. The company’s depreciation policy is to provide 10% per annum on original cost, assuming no residual value.

The replacement cost of non-current assets at 31 December was as follows:

(iii) Based upon these two inflation adjustments, why may it be misleading to compare a company’s results for one year with that of another without adjusting for changes in general (RPI) or specific inflation?

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster