Question: ENTERPRISE VALUATIONAPV MODEL This problem uses the information from Problem 9-3 about Canton Corporation to estimate the firms enterprise value using the APV model. a.

ENTERPRISE VALUATION—APV MODEL This problem uses the information from Problem 9-3 about Canton Corporation to estimate the firm’s enterprise value using the APV model.

a. What is the firm’s unlevered cost of equity?

b. What are the unlevered free cash flows for Canton for Years 1 through 4? (Hint:

The unlevered free cash flows are the same as the firm free cash flows.)

c. What are the interest tax savings for Canton Corp. for Years 1 through 4?

d: Assuming that the firm’s future cash flows from operations (i.e., its FCFs) and its interest tax savings are level perpetuities for Year 5 and beyond that equal their Year 4 values, what is your estimate of the enterprise value of Canton Corp.?

e. Based on your estimate of enterprise value, what is the value per share of equity for the firm if the firm has two million shares outstanding? (Remember that your calculations to this point have been in thousands of dollars.)

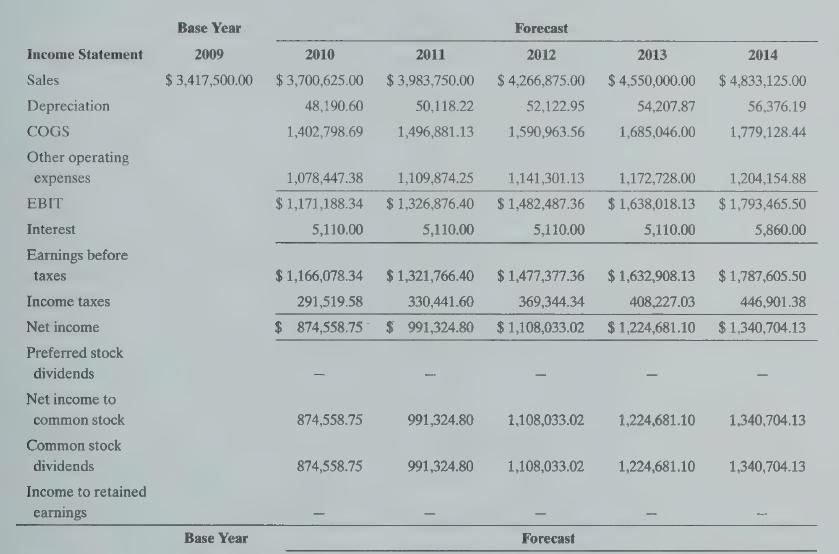

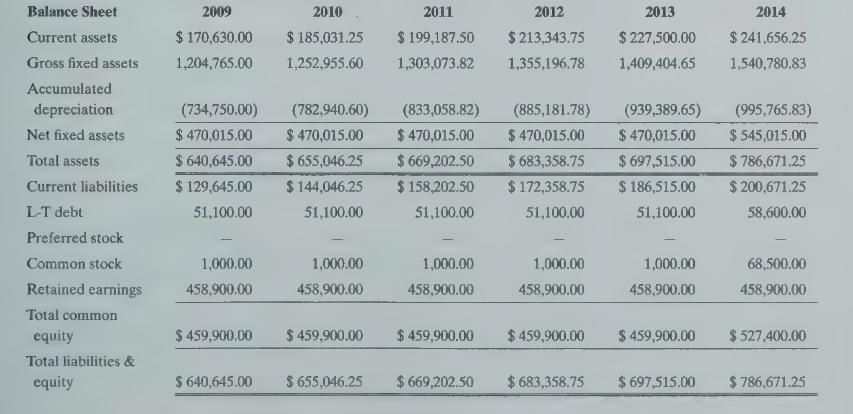

Base Year Income Statement Sales Depreciation 2009 $ 3,417,500.00 $3,700,625.00 COGS Other operating expenses EBIT Interest Earnings before taxes Income taxes Net income Preferred stock dividends Net income to common stock Common stock dividends Income to retained earnings Base Year Forecast 2010 2011 2012 $ 3,983,750.00 $ 4,266,875.00 2013 $4,550,000.00 48,190.60 50,118.22 1,402,798.69 1,496,881.13 52,122.95 1,590,963.56 54,207.87 1,685,046.00 2014 $ 4,833,125.00 56,376.19 1,779,128.44 1,078,447.38 1,109,874.25 1,141,301.13 1,172,728.00 1,204,154.88 $ 1,171,188.34 5,110.00 $ 1,326,876.40 5,110.00 $ 1,482,487.36 $ 1,638,018.13 $1,793,465.50 5,110.00 5,110.00 5,860.00 $ 1,166,078.34 291,519.58 $ 1,321,766.40 330,441.60 $ 1,477,377.36 369,344.34 $ 874,558.75 $ 991,324.80 $ 1,108,033.02 $ 1,632,908.13 $ 1,787,605.50 446.901.38 408,227.03 $1,224,681.10 $ 1,340,704.13 874,558.75 991,324.80 1,108,033.02 1,224,681.10 1,340,704.13 874,558.75 991,324.80 1,108,033.02 1,224,681.10 1,340,704.13 Forecast

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts