Question: Experiment with the portfolio allocation model in Example 11.15 to attempt to find the best solution that maximizes the expected annual return and meets the

Experiment with the portfolio allocation model in Example 11.15 to attempt to find the best solution that maximizes the expected annual return and meets the total weighted risk constraint.

Data from Example 11.15

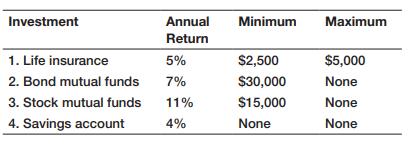

An investor has $100,000 to invest in four assets. The expected annual returns and minimum and maximum amounts with which the investor will be comfortable allocating to each investment are as follows:

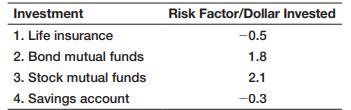

Let us assume that the risk factors per dollar allocated to each asset have been determined as follows:

Investment 1. Life insurance 2. Bond mutual funds 3. Stock mutual funds 4. Savings account Annual Return 5% 7% 11% 4% Minimum $2,500 $30,000 $15,000 None Maximum $5,000 None None None

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Portfolio Allocation Data Annual Risk factor Investm... View full answer

Get step-by-step solutions from verified subject matter experts