An interactive Future Value (Due) Chart is available on this textbooks Web site. In Chapter 12 of

Question:

An interactive Future Value (Due) Chart is available on this textbook’s Web site. In Chapter 12 of the Student Edition, find “Future Value (Due) Chart.” Use this chart to solve the following problems (rounded to the nearest dollar).

a. Exercise 12.1, Problem 5

b. Exercise 12.1, Problem 7

c. Exercise 12.1, Problem 9

d. Exercise 12.1, Problem 14

Future Value Chart:

Data From Problem 5:

Your client plans to invest $10,000 at the beginning of each year for the next 14 years. If the invested funds earn 9.1% compounded annually, what will be the total accumulated value after 14 years?

Data From Problem 7:

Today Gus is making his first annual contribution of $2500 to a TFSA. How much will the plan be worth 16 years from now if it earns 5.25% compounded monthly?

Data From Problem 9:

Today Gus is making his first annual contribution of $2500 to a TFSA. How much will the plan be worth 16 years from now if it earns 5.25% compounded monthly?

Data From Problem 14:

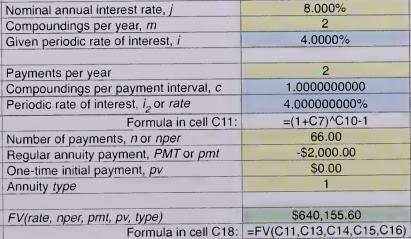

Keiko has already accumulated $150,000 in her RRSP. She intends to continue to grow her RRSP by making contributions of $500 at the beginning of every month. How much will her RRSP be worth 15 years from now if the RRSP earns 8% compounded annually?

Step by Step Answer: