Randy Johnson is an insurance adjustor for a national auto insurance company. Using historical insurance claim data,

Question:

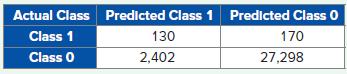

Randy Johnson is an insurance adjustor for a national auto insurance company. Using historical insurance claim data, Randy has built an insurance fraud detection model with the help of a data analyst. Applying the model on the validation data set generated the following confusion matrix. A fraudulent insurance claim is a Class 1 case while a nonfraudulent claim is a Class 0 case.

a. Compute the misclassification rate, accuracy rate, sensitivity, precision, and specificity of the classification model.

b. Should the data be oversampled to produce a more reliable classification model?

c. The confusion matrix was generated based on a cutoff rate of 0.5. If the cost of missing a fraudulent insurance claim is much higher than the cost of investigating a potentially fraudulent insurance claim, should the cutoff rate be increased or decreased when classifying claims?

Step by Step Answer:

Business Analytics Communicating With Numbers

ISBN: 9781260785005

1st Edition

Authors: Sanjiv Jaggia, Alison Kelly, Kevin Lertwachara, Leida Chen