Consider an investor's choice of a farm unit in the Corn Belt, one in the California...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

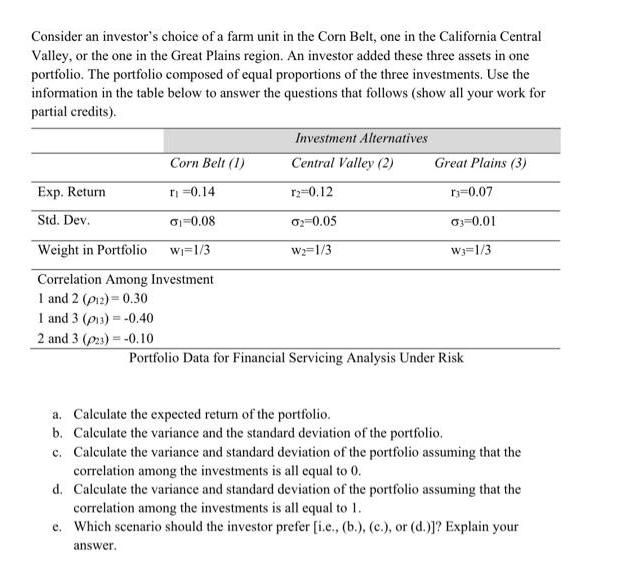

Consider an investor's choice of a farm unit in the Corn Belt, one in the California Central Valley, or the one in the Great Plains region. An investor added these three assets in one portfolio. The portfolio composed of equal proportions of the three investments. Use the information in the table below to answer the questions that follows (show all your work for partial credits). Exp. Return Std. Dev. Corn Belt (1) T₁ = 0.14 0₁ 0.08 Weight in Portfolio W₁=1/3 Correlation Among Investment 1 and 2 (P12) = 0.30 1 and 3 (p13) = -0.40 2 and 3 (23) = -0.10 Investment Alternatives Central Valley (2) r2=0.12 02-0.05 W₂=1/3 Great Plains (3) r=0.07 03-0.01 W3 1/3 Portfolio Data for Financial Servicing Analysis Under Risk a. Calculate the expected return of the portfolio. b. Calculate the variance and the standard deviation of the portfolio. c. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 0. d. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 1. e. Which scenario should the investor prefer [i.e., (b.), (c.), or (d.)]? Explain your answer. Consider an investor's choice of a farm unit in the Corn Belt, one in the California Central Valley, or the one in the Great Plains region. An investor added these three assets in one portfolio. The portfolio composed of equal proportions of the three investments. Use the information in the table below to answer the questions that follows (show all your work for partial credits). Exp. Return Std. Dev. Corn Belt (1) T₁ = 0.14 0₁ 0.08 Weight in Portfolio W₁=1/3 Correlation Among Investment 1 and 2 (P12) = 0.30 1 and 3 (p13) = -0.40 2 and 3 (23) = -0.10 Investment Alternatives Central Valley (2) r2=0.12 02-0.05 W₂=1/3 Great Plains (3) r=0.07 03-0.01 W3 1/3 Portfolio Data for Financial Servicing Analysis Under Risk a. Calculate the expected return of the portfolio. b. Calculate the variance and the standard deviation of the portfolio. c. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 0. d. Calculate the variance and standard deviation of the portfolio assuming that the correlation among the investments is all equal to 1. e. Which scenario should the investor prefer [i.e., (b.), (c.), or (d.)]? Explain your answer.

Expert Answer:

Related Book For

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins

Posted Date:

Students also viewed these economics questions

-

Use the information in the table below to answer the following questions. a. What is the current dividend yield for Boeing Company (BA) based on the stock's recent closing price? b. What is your...

-

Use the table below to answer the questions that follow: a. If this table reflects the supply of and demands for tickets to a particular World Cup soccer game, what is the stadium capacity? b. If the...

-

Use the information given in the table below to answer the questions below concerning the elements Q, R, S, T and X. a. Which element has 22 neutrons in each atom? b. Which element is a noble gas? c....

-

List and describe the payment options (terms of sale) that can be applied to domestic U.S. shipments.

-

The following information is extracted from a villages governmental funds statement of revenues, expenditures, and changes in fund balances (amounts in thousands). Compute the villages operating...

-

Wilco Corporation has the following equity balances at December 31, 2015. Prepare Wilcos December 31, 2015, equity section in the statement of financial position. Share capital-ordinary, 5 par value...

-

Zappos.com is a popular website known mainly for its discounted shoe sales. In 2012, a hacker hacked into the Zappos website in an effort to obtain the personal account information of Zappos...

-

(Issuance and Retirement of Bonds) Venezuela Co. is building a new hockey arena at a cost of $2,500,000. It received a down payment of $500,000 from local businesses to support the project, and now...

-

Find the missing side lengths (in kilometers). (The sketches are not to scale.) 33 km 24 km 48 89 x 15 km 48% 89 22 km X = y = km E E km

-

The commercial loan operation of a financial institution has a standard for processing new loan applications in 24 hours. Table 7E.2 shows the number of applications processed each day for the last...

-

Use the present value table in Appendix A and Appendix B to compute the NPV of each of the following cash outflows: Required: a. $36,500 paid at the end of four years. The discount rate is 6 percent....

-

Which of these statements is most accurate? Benefits and costs of sustainability programs fall equally across all supply chain members throughout most initiatives. Customers tend to be vocal about...

-

The goal of optimization in revenue management is to identify a tactic using forecasts of customer behavior that will be most effective. using linear regression that will maximize revenue. using...

-

How can a manufacturer tackle seasonal demand in operations planning?

-

Which of the following is needed when coordination between groups requires them to act against their traditional operating methods? Good supplier relations Round table meetings High level support...

-

Which of the following is an approach a company can use to create a buffer for forecast error using safety inventory? Build and carry extra inventories Carry extra workforce permanently Overtime...

-

For the following construction project, the indirect cost is estimated to be $250/day. The relationships among the seven activities and their time-cost data are given below. Find the crashing...

-

Write electron configurations for the following ions, and determine which have noble-gas configurations: (a) Cd2+ (b) p3- (c) Zr4+ (d) Ru3+ (e) As3- (f) Ag+

-

Using the information in Problem 9-58, complete the following: Current Proposed Materials and purchased parts $ 60.00 $ 15.00 Direct labor 12.50 13.75 Variable overhead 25.00 30.00 Fixed overhead...

-

Solidtronic, Inc., an OEM manufacturer, has a product specification of 75 + / 5. The cost for warranty services is estimated as $500 per unit. What is the value of k, the cost coefficient, in the...

-

Williams Performance Co. manufactures sports cars. After making a sale, the salesperson sends the car to be detailed before the customer takes it home. Detailing the car takes 30 minutes at a cost of...

-

On Wednesday, Paul bought more wrapping paper for 46 cash. However, it was raining hard for much of the day and sales were slow. After Paul had sold half of his total inventories for 32, he decided...

-

Try drawing up a statement of financial position for Jerry and Company as at 4 March.

-

Assume a business owns a 50 percent stake in a gold mine. As this ownership stake will not give control over the whole of the gold mine, can this resource be regarded as an asset of the business?

Studies In The History Of Latin American Economic Thought 1st Edition - ISBN: 1138866164 - Free Book

Study smarter with the SolutionInn App