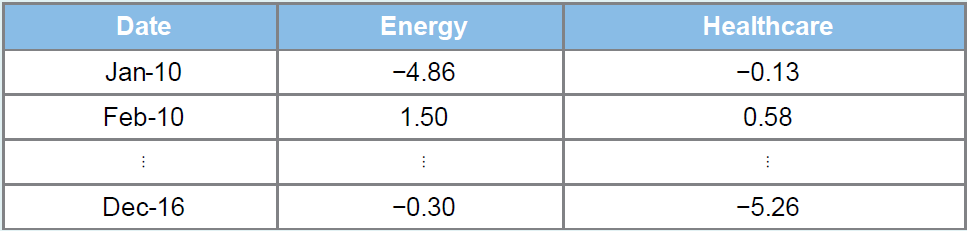

The following table shows a portion of the monthly returns data (in percent) for 20102016 for two

Question:

The following table shows a portion of the monthly returns data (in percent) for 2010–2016 for two of Vanguard’s mutual funds: the Vanguard Energy Fund and the Vanguard Healthcare Fund.

a. Calculate and interpret the sample correlation coefficient rxy.

b. Specify the competing hypotheses in order to determine whether the population correlation coefficient is different from zero.

c. At the 5% significance level, what is the conclusion to the test? Are the returns on the mutual funds correlated?

Mutual FundsMutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Statistics Communicating With Numbers

ISBN: 9781259957611

3rd Edition

Authors: Sanjiv Jaggia

Question Posted: