Carry out a sensitivity analysis of the adipic acid project described in Examples 6.11 and 6.12. Data

Question:

Carry out a sensitivity analysis of the adipic acid project described in Examples 6.11 and 6.12.

Data from example 6.11

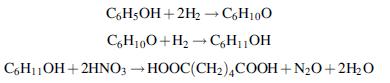

Adipic acid is used in the manufacture of nylon 6,6. It is made by hydrogenation of phenol to a mixture of cyclohexanol and cyclohexanone (known as KA oil – ketone and alcohol), followed by oxidation with nitric acid. The overall reaction can be written approximately as:

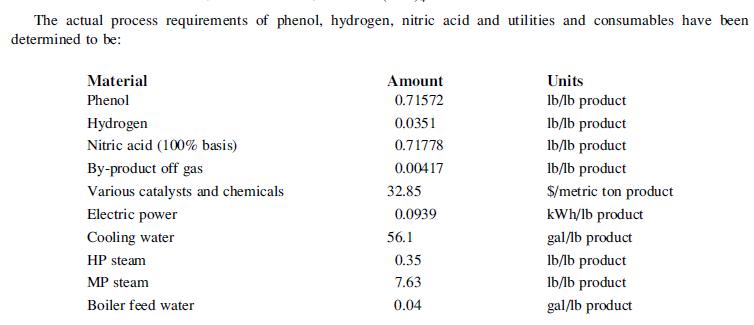

These yields were taken from Chem Systems PERP report 98/99-3 Adipic acid (Chem Systems, 1999). The nitric acid consumption is given on a 100% basis, but 60% nitric acid is used in the process. Estimate the fixed capital cost, the working capital, the cash cost of production and total cost of production for a new 400,000 metric ton per year (400 kt/y) adipic acid plant located in Northeast Asia. The prices of adipic acid, phenol, hydrogen and nitric acid have been forecasted for Northeast Asia as $1400/t, $1000/t, $1100/t and $380/t respectively. Assume a 15% cost of capital and a 10-year project life.

Data from example 6.12

The adipic acid plant in Example 6.11 is built with 30% of the fixed investment in year 1 and 70% in year 2, and the plant operates at 50% of capacity in year 3 before reaching full capacity in year 4. The plant can be depreciated by the straight-line method over ten years and profits can be assumed to be taxed at 35% per year, payable the next year. Assume that losses cannot be offset against revenues from other operations for tax purposes (i.e., no tax credits in years when the plant makes a loss). Estimate the following:

1. The cash flow in each year of the project.

2. The simple pay-back period.

3. The net present value with a 15% cost of capital for 10 years and 15 years of production at full capacity.

4. The DCFROR for 15 years of production at full capacity. Is this an attractive investment?

Step by Step Answer:

Chemical Engineering Design

ISBN: 9780081025994

6th Edition

Authors: Ray Sinnott, R.K. Sinnott, Sinnott Gavin Towler