Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject

Question:

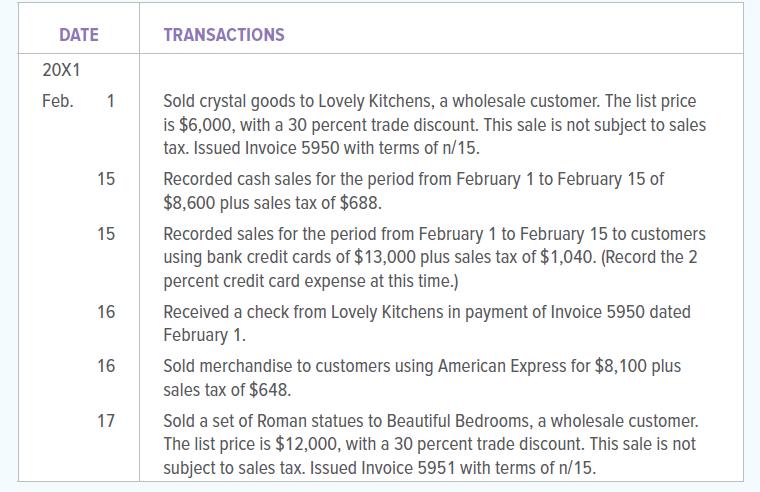

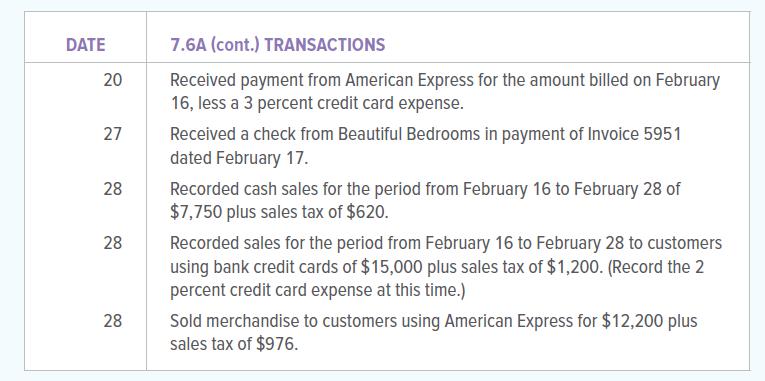

Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales tax. The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. The bank credit cards charge a 2 percent fee. American Express charges a 3 percent fee. Royal Gift Shop also grants trade discounts to certain wholesale customers who place large orders. These orders are not subject to sales tax. During February 20X1, Royal Gift Shop engaged in the following transactions:

INSTRUCTIONS

1. Open the general ledger accounts indicated below and enter the balances as of February 1, 20X1.

2. Record the transactions in a general journal. Use 10 as the journal page number.

3. Post the entries from the general journal to the appropriate accounts in the general ledger.

GENERAL LEDGER ACCOUNTS

Analyze:

What was the total credit card expense incurred in February?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina