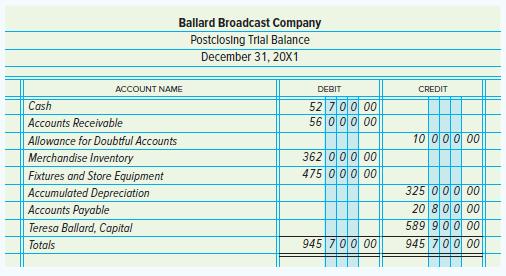

Teresa Ballard operates the Ballard Broadcast Company. Her post-closing trial balance on December 31, 20X1, is as

Question:

Teresa Ballard operates the Ballard Broadcast Company. Her post-closing trial balance on December 31, 20X1, is as follows:

Ballard agrees to enter into a partnership with Helena Pittman, effective January 1, 20X2. Profits and losses will be shared equally. Ballard is to transfer the assets and liabilities of her store to the partnership after revaluation as agreed. Pittman will invest cash equal to one-half of Ballard’s investment after revaluation. The agreed-upon values are Accounts Receivable (net), $42,200; Merchandise Inventory, $388,000; and Fixtures and Store Equipment (net), $372,000. All liabilities are properly recorded. The partnership will operate as the Ballard-Pittman Broadcast Company.

INSTRUCTIONS

1. In general journal form, prepare the entries to record the following on the books of the partnership:

a. The receipt of Ballard’s investment of assets and liabilities in the partnership.

b. The receipt of Pittman’s investment of cash.

2. Prepare a balance sheet for Ballard-Pittman Broadcast Company for January 1, 20X2.

Analyze: By what net amount was Ballard’s equity adjusted before the partnership was formed?

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 9781260247909

16th Edition

Authors: David Haddock, John Price, Michael Farina