Given the following data from the payroll register of Johnson Construction, prepare the journal entry to record

Question:

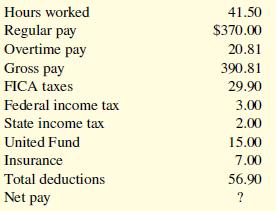

Given the following data from the payroll register of Johnson Construction, prepare the journal entry to record payroll for the week ending May 20. Then, prepare the journal entry to pay payroll on May 28.

Transcribed Image Text:

Hours worked 41.50 Regular pay Overtime pay $370.00 20.81 Gross pay 390.81 FICA taxes 29.90 Federal income tax 3.00 State income tax 2.00 United Fund 15.00 Insurance 7.00 Total deductions Net pay 56.90 раy ?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Salaries and Wages Expense 39081 FICA Taxes Payable 2990 Federal Income Taxes Payable 3...View the full answer

Answered By

WAHIDUL HAQUE

hello,

I'm a professional academic solution provider working as a freelance academic solution provider since 7 years. I have completed numerous projects. Help lots of students to get good marks in their exams and quizzes. I can provide any type of academic help to your homework, classwork etc, if you are a student of Accounting, Finance, Economics, Statistics. I believe in satisfying client by my work quality, rather than making one-time profit. I charge reasonable so that we make good long term relationship. why will you choose me? i am an extremely passionate, boldly honest, ethically driven and pro-active contractor that holds each of my clients in high regards throughout all my business relations. in addition, I'll always make sure that I'm giving my 100% better in every work that will be entrusted to me to be able to produce an outcome that will meet my client's standards. so if you are a student that is now reading my profile and considering me for your academic help. please feel free to look through my working history, feedback and contact me if you see or read something that interests you. I appreciate your time and consideration.

regards

4.90+

233+ Reviews

368+ Question Solved

Related Book For

College Accounting

ISBN: 1986

1st Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell

Question Posted:

Students also viewed these Business questions

-

The book keeper for P into Co. of Peter borough gathered the following data from employee earnings records as well as daily time cards. Your task is (1) to complete a payroll register on November 5...

-

The book keeper for P into Co. of Peter borough gathered the following data from employee earnings records as well as daily time cards. Your task is (1) to complete a payroll register on November 5...

-

The bookkeeper for Pinto Co. of Peterborough gathered the following data from employee earnings records as well as daily time cards. Your task is (a) To complete a payroll register on November 5 and...

-

Westile Company buys plain ceramic tiles and prints different designs on them for souvenir and gift stores. It buys the tiles from a small company in Europe, so at all times it keeps on hand a stock...

-

Assume that f is a Cn+1 functional on a convex set S. For fixed x0 S and x S - x0, define g: S by g(t) = x0 + tx. Show that the composite function h = f g: is Cn+1 with derivatives (k) h)(1) =...

-

Draw a dataflow graph and an activity template for the following programming construct: if (x >= 0) {

-

Based on the design, briefly discuss the data collection procedures to be used. Be sure to include the area rea of focus and targeted sample as part of these procedures. Develop a hypothetical...

-

Nadal Inc. has two temporary differences at the end of 2008. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadals accounting...

-

Question 1 Let X be a finite set of prizes and A(X) be the set of lotteries over those prizes. Show that, if a set of preferences > on A(X) has an expected utility representation, then it must be the...

-

Modify the Student class in Listing 8.2 so that it implements the comparable interface. Define the compareTo method to order Student objects based on the value in studentNumber. In a main method...

-

Mayberry Company has a fringe benefit plan for its employees. It grants employees 2 days vacation for each month worked. Ten employees worked the entire month of March at an average daily wage of...

-

What does FICA stand for?

-

The Erskine Inc. Metals Division manufactures an industrial compound used in metal working at the divisions only plant. The production process uses two materials. The first is a lubricant produced by...

-

You are talking with the client and trying to devise a solution to a problem and this client is making the situation much more complicated than it needs to be. You have a firm sense of the solution....

-

What are the three (3) basic types of engine coolant used in modern engines. Explain the difference between types of engine coolant. List the four (4) most common color's and explain what each are...

-

Discussed two similar technologies: Film and Television, please include: Discuss some of the important similarities and differences between Movies and TV.

-

You just won the TVM Lottery. You will receive $1 million today plus another 10 annual payments that increase by $700,000 per year. Thus, in one year, you receive $1.70 million. In two years you get...

-

Your department team leader has stated that corporate is planning a comprehensive audit on inventory to better understand related costs. What inventory cost will the audit MOST likely present in its...

-

Selected financial information of Banji Company for the year ended December 31, 2017, follows. Cash from investing activities ............................. $1,600 Net increase in cash...

-

In Exercises 15 through 30, find the derivative dy/dx. In some of these problems, you may need to use implicit differentiation or logarithmic differentiation. y ex + et -2x 1 + e

-

Using the information given in Exercise 5Apx-1B and the rates shown in Figure 5A-4, prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each...

-

Why is it important for payroll accounting purposes to distinguish between an employee and an independent contractor?

-

Name three major categories of deductions from an employees gross pay.

-

Bob and Sally are both shareholders of XYZ Corporation. The annual shareholders' meeting is coming up, and they want to know how many "votes" they each have. What things must they look at to...

-

Taking Possession of the Collateral When the debtor defaults, the secured party may take possession of the collateral. How does the secured party do so?

-

Collateral is required as enhancement of the borrowers credit. Elaborate on the purpose and extent of offering security from the perspective of the borrower.?

Study smarter with the SolutionInn App