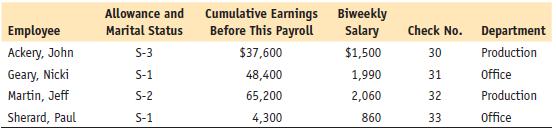

You gathered the following data from time cards and individual employee earnings records. Your tasks are as

Question:

You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows:

1. On December 5, 201X, prepare a payroll register for this biweekly payroll.

2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA, and SUTA.

3. Journalize the Payroll Register & Employer’s tax liability.

Assume the following:

1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1.45% on all earnings.

2. Federal income tax is calculated from Figure 7.2.

3. State income tax is 8% of gross pay.

4. Union dues are $12 biweekly.

5. The SUTA rate is 5.4%, and the FUTA rate is 0.6% on earnings up to $7,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780133791006

13th Edition

Authors: Jeffrey Slater

Question Posted: