Capistrano Corporation, whose reporting currency is the franc (F), establishes a foreign subsidiary, whose reporting currency is

Question:

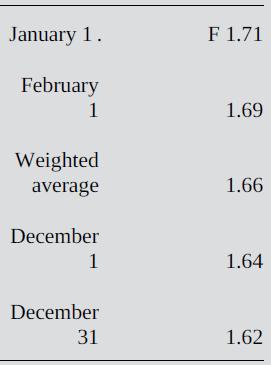

Capistrano Corporation, whose reporting currency is the franc (F), establishes a foreign subsidiary, whose reporting currency is the escudo (E). On January 1, Year 1, Capistrano contributes Cash of E5,000 to the subsidiary in exchange for Common Stock, and the subsidiary purchases Land for E15,000 by negotiating a ten-year Note Payable of E15,000. On February 1, Year 1, the subsidiary purchases Equipment for E4,000. Sales, Salary Expense, and Other Operating Expenses are incurred evenly throughout Year 1. The subsidiary declares Dividends of E8,000 on December 1, Year 1. Relevant exchange rates for Year 1 are as follows (franc per escudo):

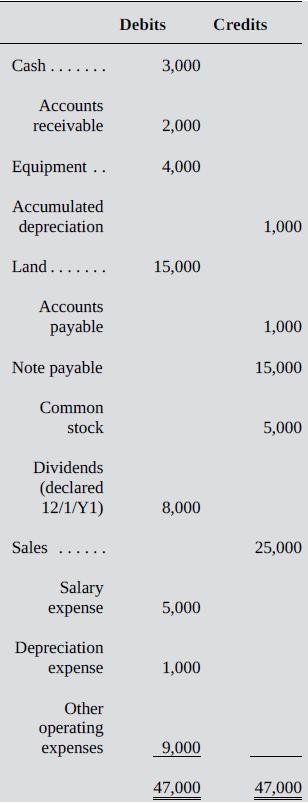

On December 31, Year 1, the subsidiary reports the following trial balance (in escudos):

Required:

a. Assume that the foreign subsidiary’s functional currency is the escudo (E). Prepare a trial balance for it in francs (F) so that Year 1 consolidated financial statements can be prepared. Show the calculation of translation adjustment for Year 1. Ignore income taxes.

b. Assume that the foreign subsidiary’s functional currency is the franc (F). Prepare a trial balance for it in francs (F) so that Year 1 consolidated financial statements can be prepared. Show the calculation of remeasurement gain (loss) for Year 1. Ignore income taxes.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera