John and Ellen Brite are married, file a joint return, and are less than 65 years old.

Question:

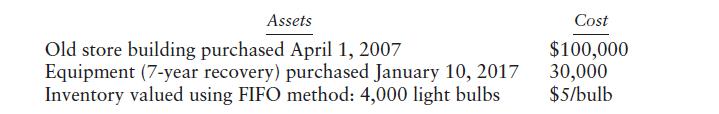

John and Ellen Brite are married, file a joint return, and are less than 65 years old. They have no dependents and claim the standard deduction. John owns an unincorporated specialty electrical lighting retail store, Brite-On. Brite-On had the following assets on January 1, 2022:

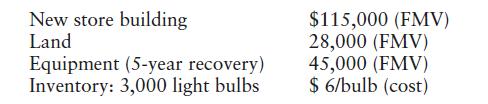

Brite-On purchased a competitor’s store on March 1, 2022, for \($206,000\) The purchase price included the following:

On June 30, 2022, Brite-On sold the 7-year recovery period equipment for \($12,000\).

Brite-On leased a car for \($860/month\) beginning on June 1, 2022. The car is used 100%

for business.

Brite-On sold 8,000 light bulbs at a price of \($15/bulb\) during the year. Also, Brite-On made additional purchases of 4,000 light bulbs in August 2022 at a cost of \($7\) bulb.

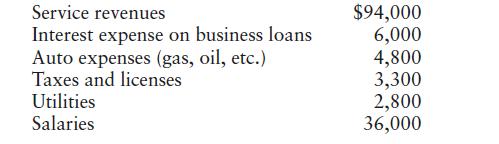

Brite-On had the following revenues (in addition to the sales of light bulbs) and additional expenses:

Ellen receives \($42,000\) of wages from employment elsewhere, from which \($4,000\) of federal income taxes were withheld. John and Ellen made four \($3,100\) quarterly estimated tax payments. For self-employment tax purposes, assume John spent 100% of his time at the store while Ellen spends no time at the store.

Additional Facts:

• Equipment acquired in 2017: The Brites elected out of bonus depreciation and did not elect Sec. 179. The half-year convention applies for this property.

• Equipment acquired in 2022: The Brites elected Sec. 179 to expense the cost of the 5-year equipment.

• Assume that the lease inclusion rules require that Brite-On reduce its annual deductible lease expense by \($41\).

Compute the Brite’s taxable income and balance due or refund for 2022.

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson