Phillips Corporation, a construction company that specializes in home construction, uses special computer software to schedule jobs

Question:

Phillips Corporation, a construction company that specializes in home construction, uses special computer software to schedule jobs and keep track of job costs. It uses generic software for bookkeeping and spreadsheet analysis. During 2023, Phillips Corporation had the following transactions relating to computer software:

• The corporation purchased a new computer system on May 12, 2023, for \($15,000\).

The system included computer hardware and built-in computer software valued at \($3,000.\) The corporation has never separated computer software from the hardware in prior years when a computer system was purchased.

• The corporation separately purchased new bookkeeping software on September 1, 2023, for \($5,760\).

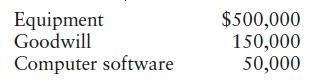

• On June 1, 2023, Phillips Corporation acquired another home building company to strengthen its position in higher-priced homes. The total purchase price was \($700,000\) allocated to specific assets as follows:

What amount can Phillips Corporation deduct in 2023 with respect to computer software?

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson