On June 2, 2018, Lokar Corporation purchases a patent for $68,000 from the inventor of a new

Question:

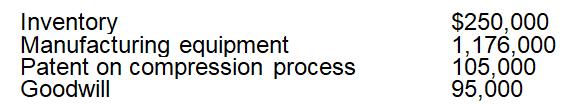

On June 2, 2018, Lokar Corporation purchases a patent for $68,000 from the inventor of a new extrusion process. The patent has 12 years remaining on its legal life. Also, Lokar purchases substantially all of the assets of Barrios Corporation for $750,000 on September 8, 2018. The values of the assets listed in the purchase agreement are as follows:

Determine the maximum 2018 cost-recovery deductions for the assets purchased.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: