Question:

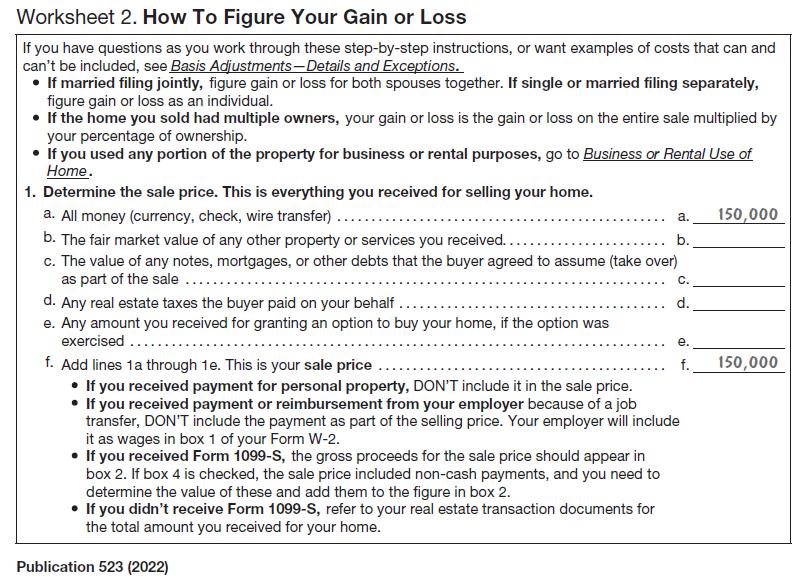

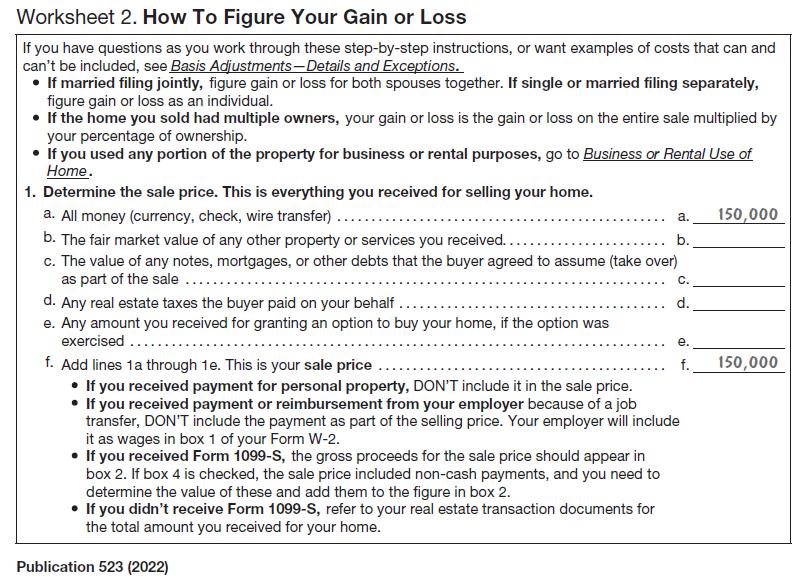

On October 29, 2022, Miss Joan Seely (SSN 123-45-6789) sells her principal residence for \($150,000\) cash. She purchased the residence on May 12, 2013, for \($85,000.\) She spent \($12,000\) for capital improvements in 2013. To help sell the house, she pays \($300\) for minor repairs. The realtor’s commission amounts to \($7,500.\) Her old residence is never rented out or used for business. Complete the worksheets in Publication 523 to determine the recognized gain for Miss Seely for 2022.

Data From Work Sheet Publication 523

Transcribed Image Text:

Worksheet 2. How To Figure Your Gain or Loss If you have questions as you work through these step-by-step instructions, or want examples of costs that can and can't be included, see Basis Adjustments-Details and Exceptions. If married filing jointly, figure gain or loss for both spouses together. If single or married filing separately, figure gain or loss as an individual. If the home you sold had multiple owners, your gain or loss is the gain or loss on the entire sale multiplied by your percentage of ownership. If you used any portion of the property for business or rental purposes, go to Business or Rental Use of Home. 1. Determine the sale price. This is everything you received for selling your home. a. All money (currency, check, wire transfer) ..... b. The fair market value of any other property or services you received..... c. The value of any notes, mortgages, or other debts that the buyer agreed to assume (take over) as part of the sale ... d. Any real estate taxes the buyer paid on your behalf. e. Any amount you received for granting an option to buy your home, if the option was exercised...... f. Add lines 1a through 1e. This is your sale price.... If you received payment for personal property, DON'T include it in the sale price. If you received payment or reimbursement from your employer because of a job transfer, DON'T include the payment as part of the selling price. Your employer will include it as wages in box 1 of your Form W-2. If you received Form 1099-S, the gross proceeds for the sale price should appear in box 2. If box 4 is checked, the sale price included non-cash payments, and you need to determine the value of these and add them to the figure in box 2. If you didn't receive Form 1099-S, refer to your real estate transaction documents for the total amount you received for your home. Publication 523 (2022) a. 150,000 b. C. d. e. f. 150,000