Alice and Frank have the following items on their 2020 tax return: Determine the amount of the

Question:

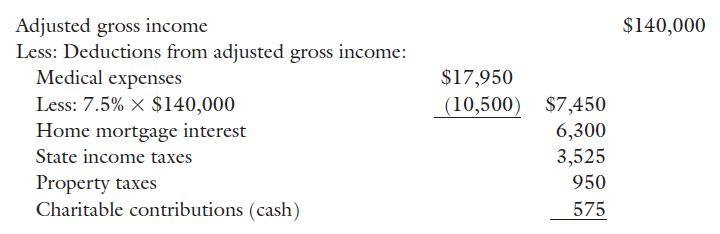

Alice and Frank have the following items on their 2020 tax return:

Determine the amount of the adjustments that Alice and Frank will have to make in computing their alternative minimum tax.

Transcribed Image Text:

Adjusted gross income Less: Deductions from adjusted gross income: Medical expenses Less: 7.5% x $140,000 Home mortgage interest $140,000 $17,950 (10,500) $7,450 6,300 State income taxes 3,525 950 Property taxes Charitable contributions (cash) 575

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

The primary adjustments that are required of individual taxpayers are for deductions from adjusted g...View the full answer

Answered By

Hamza Amjad

Currently I am student in master degree program.from last two year I am tutring in Academy and I tought many O/A level student in home tution.

4.80+

3+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted:

Students also viewed these Business questions

-

Alice and Frank have the following items on their current-year tax return: Determine the amount of the adjustments that Alice and Frank will have to make in computing their alternative minimumtax....

-

Alice and Frank have the following items on their current-year tax return: Determine the amount of the adjustments that Alice and Frank will have to make in computing their alternative minimum tax....

-

Joan and Matthew are married, have two children, and report the following items on their 2020 tax return: Determine Joan and Matthews regular tax liability and, if applicable, the amount of their...

-

The city of Toledo has received a proposal to build a new multipurpose outdoor sports stadium. The expected life of the stadium is 20 years. It will be financed by a 20- year bond paying 8 percent...

-

An ambitious young worker claims that older employees have a better chance of being CEOs than younger employees. To confirm this, he sampled the ages of CEOs for 31 companies. The mean age in the...

-

Prior to the first meeting of the RWW Enterprise Policy Review Committee, Mike asked Iris to meet him in his office. Youve convinced me that IT and InfoSec policy are tightly integrated, Mike said,...

-

Water at \(60^{\circ} \mathrm{F}\) flows through a 6-in.-diameter pipe with an average velocity of \(15 \mathrm{ft} / \mathrm{s}\). Approximately what is the height of the largest roughness element...

-

As discussed in the chapter, U.S. GAAP accounting for leases allows companies to use off???balance-sheet financing for the purchase of operating assets. International accounting standards are similar...

-

I think value pricing should be used since we are increasing product and service benefits while maintaining a reasonable price. Some products, price influences consumers perception of overall quality...

-

Richard chooses technique 0 and 2 requiring 10+10-20 efforts and provising 10+11=21 benefits. Hence, 21 is returned as the output Example 2: input1: 3 input2: (10,10,10,10) input3: (10,11,12,15)...

-

Lavinia owns an advertising agency. In February 2020, she purchases a building for $125,000. Lavinia spends $275,000 rehabilitating the building for use as her advertising agency office. The...

-

The Collins Corporation, a domestic corporation, owns 65 percent of ODwyer, a foreign corporation. During the current year, Logo receives $120,000 in dividends. ODwyers post-1986 undistributed U.S....

-

Stanton Manufacturing is considering three capital investment proposals. At this time, the company has funds available to pursue only one of the three investments. Requirement Which investment should...

-

A simple model for the hull of a ship is given by: (Note: There are two values of y for each x and z because the hull is symmetric from starboard to port.) The cross-sectional area at a point x is...

-

What is the debugging phenomenon known as cycling? What can you do to avoid it?

-

Enhance the CashRegister class so that it counts the purchased items. Provide a get ItemCount method that returns the count.

-

The CashRegister class has an unfortunate limitation: It is closely tied to the coin system in the United States and Canada. Research the system used in most of Europe. Your goal is to produce a cash...

-

Consider the possibility of unrolling the loop and mapping multiple iterations to vector operations. Assume that you can use scatter-gather loads and stores (vldi and vsti). How does this affect the...

-

Accrued pension benefits represent an obligation of a company for the past service of its employees. No current or future action can affect this obligation. The amortization of accrued pension...

-

Read Case Study Google: Dont Be Evil Unless and answer the following: Why do you think Google was adamant about not wanting to supply information requested by the government concerning the Child...

-

Read the article The Governance of Nonprofit Organizations: Integrating Agency theory With Stakeholder and Stewardship Theories by Stijn Van Puyvelde, Ralf Caers, Cind Du Bois, and Marc Jegers. (See...

-

Read the article, Preserving the Publicness of the Nonprofit Sector: Resources, Roles, and Public Values by Stephanie Moulton and Adam Eckerd. Describe resource dependency theory and identify the...

-

Read the article, Preserving the Publicness of the Nonprofit Sector: Resources, Roles, and Public Values by Stephanie Moulton and Adam Eckerd. Explain how open systems theory is used to study how the...

-

How do Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) paradigms transform traditional network architecture, and what challenges might arise when implementing these...

-

The pension fund you manage must make a payment of $250,000 in ten years. The ten-year interest rate is currently 8% per annum. You want to fund this liability using five-year zero-coupon bonds and...

-

A 1-year zero coupon bond has a YTM of 10%. A 2-year zero coupon bond has a YTM of 12%. Both are riskless. What is the price of a 2-year, annual 5% coupon paying bond with face value of $1,000?

Study smarter with the SolutionInn App